Loading

Get Aer Form 770

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aer Form 770 online

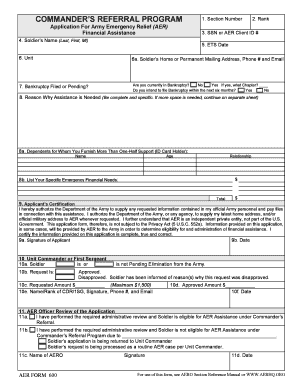

Filling out the Aer Form 770 online can be a straightforward process with the right guidance. This document provides you with detailed instructions to navigate each section of the form effectively.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin with section one, where you will enter the AER Section number if known. This identifies the particular assistance request.

- Proceed to fill in your rank, SSN or AER Client ID number, and the soldier's name in the specified format: Last, First, MI.

- Input your ETS Date and Unit. Ensure that the dates are formatted correctly according to the application's requirements.

- In section 6a, provide your home or permanent mailing address along with your phone number and email. You have multiple lines to use if needed.

- Address the bankruptcy section (7) by checking 'Yes' or 'No' and specifying the chapter if applicable. If intending to file for bankruptcy within six months, please indicate that as well.

- In section 8, describe clearly and specifically why assistance is needed. If your explanation requires more space, continue on a separate sheet, as needed.

- List any dependents for whom you provide more than one-half support in section 8a. Include their name, age, relationship, and any relevant financial information.

- In section 8b, detail your specific emergency financial needs. The total amount will be calculated automatically.

- Read through the applicant's certification in section 9 carefully. It confirms that the information provided is true and complete. There are fields for the applicant's signature and date.

- The next sections (10) are for unit commander or first sergeant approval. They will indicate whether the request is approved or disapproved, providing necessary details related to the assistance amount.

- The AER officer will review the application in section 11, marking eligibility for assistance. They will also indicate whether the request is being processed as a routine case.

- Once all sections are complete, ensure to save changes. You may have options to download, print, or share the form.

Begin filling out your documents online today for prompt assistance.

The 709 form is a federal gift tax return used to report gifts made that exceed the annual exclusion limit. It allows you to account for gifts that may have tax implications and is vital for estate planning. Understanding how the 709 form relates to the Aer Form 770 can help you navigate your financial responsibilities more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.