Get Virginia St 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia St 9 online

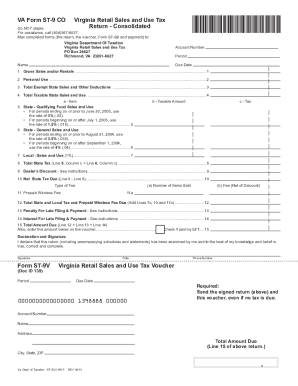

Filling out the Virginia St 9 form is an essential process for individuals and businesses required to report and remit sales and use tax in Virginia. This guide provides a clear and comprehensive overview of how to complete the Virginia St 9 online, ensuring accuracy and compliance with state regulations.

Follow the steps to complete the Virginia St 9 form online.

- Press the ‘Get Form’ button to access the Virginia St 9 form and open it in the editor of your choice.

- Begin by entering your account number in the designated field at the top of the form.

- Input the reporting period for the tax return in the specified section.

- Enter your name and address as they appear on your business documents.

- Specify the due date for this tax return as indicated for the reporting period.

- Fill in your gross sales and/or rentals for the reporting period in Line 1 of the form.

- Record any personal use of tangible personal property on Line 2.

- Detail total exempt state sales and other deductions on Line 3, ensuring you accurately categorize each type of deduction.

- Calculate total taxable state sales and use on Line 4 by subtracting Line 3 from the subtotal of Lines 1 and 2.

- Input qualifying food sales and use on Line 5, followed by general sales and use on Line 6.

- Complete Line 7 for local sales and use tax.

- Add the totals from the previous lines to compute the total state tax on Line 8.

- If applicable, include any dealer's discount on Line 9, as instructed.

- Calculate your net state tax due by deducting the dealer’s discount from the total state tax on Line 10.

- Fill in details for the prepaid wireless fee on Line 11, including the number of items sold and the calculated fee.

- Total all applicable amounts including taxes and fees on Line 12.

- Add any penalties and interest for late payments on Lines 13 and 14, respectively.

- Finalize your total amount due on Line 15 and ensure it matches the summary on your voucher.

- Review the entire form for accuracy before saving your changes, downloading, or printing the completed document.

Complete the Virginia St 9 online today to ensure your taxes are filed accurately and on time.

Filling out a Virginia small estate affidavit requires you to gather key information about the deceased's assets and debts. You will declare that the estate qualifies as a small estate under Virginia law, which typically involves assets totaling under a specific threshold. After ensuring accuracy, you can submit the affidavit to the local circuit court. To simplify this process and access templates, consider using USLegalForms for your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.