Loading

Get Illinois Rmft 11 A Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Rmft 11 A Instructions online

This guide provides detailed instructions on completing the Illinois Rmft 11 A form online, ensuring users can efficiently process their tax refund claims. By following these precise steps, individuals can navigate through the form effectively.

Follow the steps to accurately complete your refund claim.

- Press the ‘Get Form’ button to access the Illinois Rmft 11 A form and open it in the online editor.

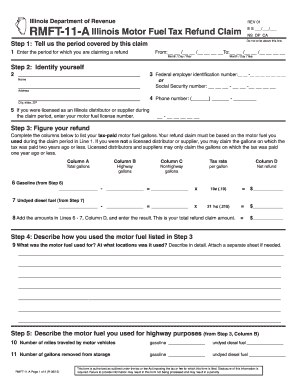

- Specify the period covered by your claim. Enter the start and end dates in the 'From' and 'To' fields respectively.

- Identify yourself by providing your name, address, and either your federal employer identification number or social security number. Additionally, include your phone number and, if applicable, your motor fuel license number.

- Complete the refund calculation section by listing the tax-paid motor fuel gallons under the correct columns, ensuring to input the tax rates and total gallons accurately.

- Describe how you utilized the motor fuel listed in your claim. Make sure to detail the purpose and any specific locations, attaching extra sheets if required.

- For highway purposes, indicate the number of miles traveled and gallons removed from storage for both gasoline and undyed diesel fuel.

- In the nonhighway section, provide detailed information regarding your use of gasoline, including the acres under cultivation and the number of gallons pumped for various purposes.

- List the gallons of undyed diesel fuel used during the claim period, differentiating between highway and nonhighway uses.

- Itemize your equipment utilized in the process. Provide a detailed description including the type of motor fuel used and gallons consumed.

- Sign the form to authenticate your claim, and indicate the date and your title if relevant.

- Finally, mail your completed refund claim to the designated address, including the original and a copy for your records.

Begin completing your Illinois Rmft 11 A form online today for a smooth refund process.

If you have questions about your Illinois tax refund, contact the Illinois Department of Revenue. They provide assistance with tax-related inquiries and can guide you on the status of your refund. For specific questions regarding motor fuel tax refunds, you may want to refer to the Illinois Rmft 11 A Instructions provided on the US Legal Forms site.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.