Get Form Sw 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Sw 4 online

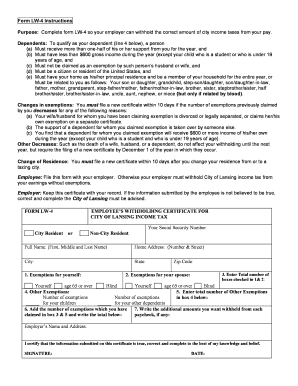

Filling out the Form Sw 4 online enables your employer to accurately withhold city income taxes from your pay. This guide will provide you with a clear, step-by-step approach to completing the form, ensuring that you understand each section and can provide the necessary information with confidence.

Follow the steps to effectively complete the Form Sw 4 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Social Security number in the designated field at the top of the form. This information is vital for tax identification purposes.

- Indicate whether you are a city resident or a non-city resident by selecting the appropriate option provided.

- Fill in your full name, including your first, middle, and last name as requested. Accuracy is important for identification.

- Provide your complete home address, including the number and street, city, state, and zip code in the respective fields.

- In section 1, specify exemptions for yourself. Check the boxes for any relevant exemptions, such as age 65 or over or blind.

- Repeat the process for section 2, entering exemptions for your spouse, if applicable. Indicate relevant exemptions by checking the appropriate boxes.

- In section 4, write down any other exemptions you can claim, such as for your children or other dependents.

- Calculate the total number of exemptions from sections 1 and 2 and enter this number in box 3.

- Add the number of exemptions from box 4, and place the total in box 5.

- Complete section 6 by adding the numbers from boxes 3 and 5 to determine your total number of claimed exemptions.

- If you wish to have additional amounts withheld from your paychecks, state these amounts in section 7.

- Provide your employer's name and address in the designated area to ensure the form is processed correctly.

- Finally, sign and date the form to certify that all information provided is true, correct, and complete, then save changes, download, print, or share the form as needed.

Start filling out the Form Sw 4 online today to ensure proper withholding of your city income taxes.

Claiming 0 on Form W-4 results in the highest amount of tax withholding, which may be beneficial if you owe taxes in the past. Conversely, claiming 1 usually results in less withholding, resulting in a larger paycheck but potentially a tax bill at the end of the year. It's advisable to evaluate your financial situation and perhaps consult with a tax professional to decide which option works best for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.