Loading

Get Mo 941x

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 941x online

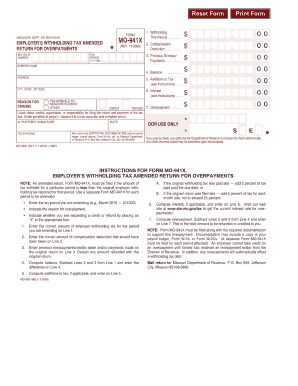

Filling out the Mo 941x form can seem challenging, but with the right guidance, it becomes much more manageable. This guide provides clear and detailed instructions to help you successfully complete the form online.

Follow the steps to fill out the Mo 941x form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields at the top of the form. This includes your name, address, and identification number. Ensure that all details are accurate to avoid any processing issues.

- Next, navigate to the section regarding your tax liability. Here, you will input the relevant figures that pertain to your tax situation. Review any documentation you have to ensure accuracy in this section.

- Proceed to the portion of the form where you indicate any adjustments or corrections needed. It is vital to provide detailed explanations for each adjustment you make. Be clear and concise to facilitate understanding.

- After completing all necessary sections, review the information you have entered. Double-check for any omissions or errors to ensure everything is correct before proceeding.

- Finally, save your changes, and you will have the options to download, print, or share the completed Mo 941x form as needed.

Complete your documents online today for a more efficient filing experience.

You should file Form 941-X when you discover an error in a previously submitted Form 941. It is important to file the form within the established timeframe, which is typically within three years of the original filing date to avoid penalties. Situational factors might warrant earlier or later filing; therefore, consulting updated guidelines is wise. US Legal Forms can offer timely reminders and instructions so you can file your 941-X in a timely manner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.