Loading

Get Ct 990 T Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 990 T Instructions Form online

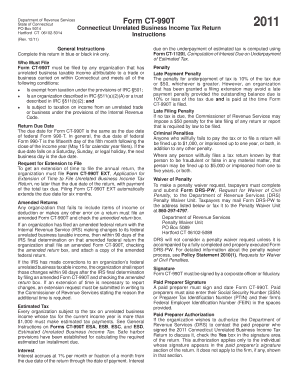

Filling out the Ct 990 T Instructions Form online can be a straightforward process when you understand the required steps. This guide offers you a clear and concise approach to successfully completing the form for your organization’s unrelated business income tax return.

Follow the steps to efficiently complete the form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your organization’s name and address at the top of the form. Ensure that the information is accurate and check the box if there is a change of mailing address.

- Provide the beginning and ending dates of your organization’s income year, as well as the Connecticut Tax Registration Number and Federal Employer Identification Number (FEIN).

- Check all applicable boxes indicating if this is an initial return, amended return, or final return to ensure proper processing.

- Complete the sections detailing the type of organization and the nature of the unrelated business activity you conduct.

- Fill out the Computation of Income, including the federal unrelated business taxable income and any operating loss deductions.

- Proceed to the Computation of Tax section and calculate the tax based on the applicable amounts you have entered.

- Review the penalty and interest sections, ensuring any underpayment or late fees are calculated accurately.

- Sign the form by a corporate officer or fiduciary. If a paid preparer assisted in the filing, they must also sign and provide their credentials.

- Once you have completed the form, options will be available for you to save changes, download, print, or share the form as necessary.

Start filling out the Ct 990 T Instructions Form online now!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Any tax-exempt organization that earns income from a business activity that is not related to its exempt purpose needs to file a 990-T. This includes charities, foundations, and other non-profits. Familiarizing yourself with the Ct 990 T Instructions Form will ensure you meet your filing obligations. If you are unsure about your status or need further help, consult uslegalforms for expert guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.