Get Nontaxable Transaction Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nontaxable Transaction Certificate online

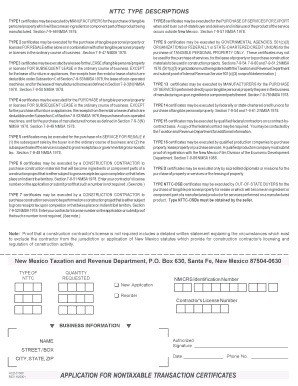

The Nontaxable Transaction Certificate (NTTC) is an essential document for New Mexico taxpayers who wish to claim nontaxable transactions. This guide provides you with clear, step-by-step instructions to complete the NTTC application online, ensuring a smooth and accurate submission process.

Follow the steps to successfully complete your Nontaxable Transaction Certificate application.

- Click ‘Get Form’ button to access the NTTC application and open it in the editor.

- Enter your business information in the designated fields. This includes your business name, street address or P.O. Box, city, state, and ZIP code. Ensure you also input your New Mexico CRS identification number and business telephone number.

- If applicable, provide your Contractor's License Number in the appropriate section. This is necessary for contractors applying for certain NTTC types related to construction.

- Select the type of NTTC you are applying for by indicating the relevant type(s) (for example, '01', '02', 'OSB', etc.) in the designated area. You can apply for multiple types if necessary.

- Specify the quantity of NTTCs you are requesting. Mark whether this application is for a new certificate or a reorder of existing certificates.

- Ensure that the application includes an authorized signature along with the date and your contact phone number. This step verifies the legitimacy of your application.

- Review all entered information carefully to ensure accuracy and completeness before finalizing your submission.

- Once verified, save the changes made to the application, and proceed to download, print, or share the completed form as needed to submit it to the New Mexico Taxation and Revenue Department.

Complete your Nontaxable Transaction Certificate online today to streamline your tax processes.

To become tax exempt in New Mexico, an individual or business must apply for and obtain the necessary certificates, such as a Nontaxable Transaction Certificate. This involves demonstrating eligibility for specific exemptions defined by New Mexico tax regulations. Once approved, you can use the NTTC to make purchases without incurring gross receipts tax. It can be helpful to utilize platforms like uslegalforms to ensure you complete the application process correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.