Get Form It - 203 - B :2010:nonresident And Part-year Resident ... - Wings - Wings Buffalo

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IT - 203 - B :2010: Nonresident And Part-Year Resident ... - Wings - Wings Buffalo online

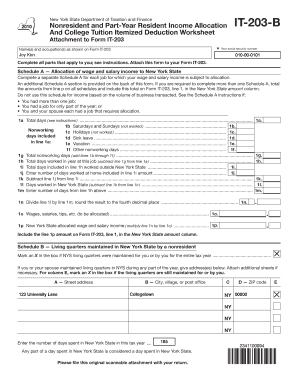

Filling out Form IT - 203 - B is an essential step for nonresidents and part-year residents seeking to allocate their income for tax purposes in New York. This guide will provide detailed, step-by-step instructions for completing the form online, ensuring you have the necessary information at your fingertips.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number in the designated field, followed by your name and occupation as stated on Form IT-203.

- Proceed to complete Schedule A, which requires you to allocate your wage and salary income to New York State. Create a separate Schedule A for each job where allocation is needed.

- For each Schedule A, fill out the total days worked during the year and categorize any nonworking days, including weekends, holidays, sick leave, vacation, and other nonworking days.

- Calculate the total nonworking days and determine your total days worked at that job, ensuring to subtract the nonworking days from the total days.

- Identify the days you worked outside New York State and any days worked at home, deducting these from your total days to find the days worked in New York.

- Record wages, salaries, tips, etc., to be allocated. Calculate your New York State allocated wage and salary income by using the appropriate formulas from the instructions.

- Move on to Schedule B if you maintained living quarters in New York State. Mark the box and provide the address and details as requested.

- Finish by completing Schedule C for the college tuition itemized deduction if applicable. Indicate if you are claimed as a dependent and provide the necessary information for each eligible student.

- Once all sections are filled, review your entries for accuracy, save your changes, and then download or print the completed form for submission.

Start completing your Form IT - 203 - B online today to ensure accurate and timely filing.

Not all non-residents are required to file an income tax return. If a non-resident earns no income sourced from New York and meets the 14 day rule, they typically do not have to file. However, if you have earned income in New York, using the Form IT - 203 - B :2010:Nonresident And Part-Year Resident ... - Wings - Wings Buffalo will help you navigate your filing requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.