Get Uniform Residential Loan Application Interactive (form 1003): Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Uniform Residential Loan Application Interactive (Form 1003): PDF online

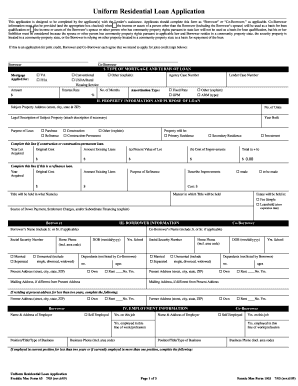

This guide provides detailed instructions for completing the Uniform Residential Loan Application Interactive (Form 1003) online. Users of all experience levels can confidently fill out this essential document with clear and supportive guidance.

Follow the steps to complete your application accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out Section I, which covers the type of mortgage and terms of the loan. Specify the mortgage applied for, the amount requested, interest rate, and amortization type. Ensure that details such as the agency case number and lender case number are accurately provided.

- In Section II, input the property information, including the address, number of units, year built, and the purpose of the loan (purchase, refinance, or construction). Specify if the property will be used as a primary residence, secondary residence, or investment.

- Proceed to Section III for borrower information. Enter the borrower's and co-borrower's names, social security numbers, marital status, present address, and contact information, ensuring that all details are accurate.

- Complete Section IV, which pertains to employment information. List the name and address of each employer, the number of years employed in that position, and monthly income from each source.

- Fill out Section V regarding monthly income and combined housing expenses. It includes gross monthly income from various sources and current housing expenses.

- In Section VI, list all assets and liabilities. Ensure to provide details about checking and savings accounts, real estate owned, and loans. Indicate all outstanding debts and monthly payments.

- Review Section VII, which contains details of the transaction, including purchase price, closing costs, and any changes in ownership, if applicable.

- Complete Section VIII, using the declarations section to disclose any relevant legal or financial questions. Respond clearly to questions regarding bankruptcy, foreclosures, and current obligations.

- Finally, review Section IX for acknowledgment and agreement, where the borrower must sign and date the application to affirm that all information is correct. If assistance was provided by a loan originator, their details should be included as well.

- Once all sections are filled, review the entire application for accuracy. Make any necessary changes before saving your updates. You can download, print, or share the form as needed.

Start filling out your Uniform Residential Loan Application online today to ensure a smooth application process.

Related links form

The Fannie Mae form 1003, also known as the Uniform Residential Loan Application Interactive (Form 1003): PDF, is a crucial document in the mortgage application process. This form collects essential information about the borrower and the property involved in the loan, ensuring lenders have the necessary details for loan assessment. By using this standardized form, you streamline your application, making it easier to process and review. With US Legal Forms, you can access and fill out this form quickly, simplifying your path to home financing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.