Loading

Get Multi-state Borrower Benefit Worksheet (for Use In All ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MULTI-STATE BORROWER BENEFIT WORKSHEET online

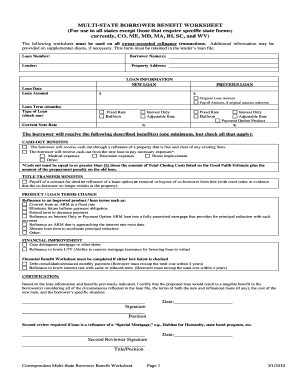

The MULTI-STATE BORROWER BENEFIT WORKSHEET is a crucial document used for owner-occupied refinance transactions across multiple states. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently, ensuring that all relevant information is included.

Follow the steps to complete the worksheet effectively.

- Click ‘Get Form’ button to obtain the worksheet and open it in your preferred document editing application.

- Fill in the loan number, borrower name(s), lender, and property address in the designated fields.

- In the Loan Information section, provide details for both the new loan and previous loan, including loan dates and amounts. If the original loan amount is unknown, include the payoff amount.

- Specify the loan term in months and select the type of loan by marking the appropriate checkbox from options like Fixed Rate, Interest Only, Adjustable Rate, or Balloon.

- Enter the current note rate percentage for the new loan and any applicable payment option product rates.

- Indicate the benefits the borrower will receive by checking all relevant options, such as Cash-Out Benefits, Title Transfer Benefits, Product/Loan Terms Change, or Financial Improvement.

- If checking Financial Improvement benefits, ensure that the Financial Benefit Worksheet is completed as required.

- In the certification section, provide the date, your signature, and position to confirm that the proposed loan will yield tangible benefits for the borrower.

- If a second review is required, enter the date and have the second reviewer sign and indicate their title/position.

- After completing the worksheet, save changes, and if necessary, download, print, or share the form as required.

Start completing your MULTI-STATE BORROWER BENEFIT WORKSHEET online today.

Fannie Mae requires borrowers to get a material benefit from the mortgage refinance — also known as a net tangible benefit. Otherwise, a new loan is a waste of money for all involved. Fannie Mae looks for at least one of the following benefits to occur: Lower monthly mortgage payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.