Get Ati Exemption Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ati Exemption Application Form online

Filling out the Ati Exemption Application Form online can be a straightforward process when you understand the required steps. This guide provides clear instructions to help you complete the form accurately and submit it successfully.

Follow the steps to fill out the Ati Exemption Application Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

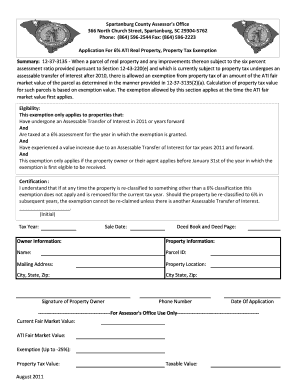

- Begin by entering the tax year for which you are applying for the exemption. This is critical for ensuring your application is processed correctly.

- Provide the sale date of the property. This date needs to reflect when the property underwent an assessable transfer of interest.

- In the 'Deed Book and Deed Page' section, enter the appropriate information that correlates with your property’s deed.

- Fill out the 'Owner Information' section, including your name, mailing address, and phone number. Accurate details are essential for correspondence.

- Next, provide the 'Property Information' which includes the parcel ID and the exact location of the property, ensuring it corresponds to official records.

- Review the certification statement carefully. It confirms your understanding that the exemption will be removed if the property is re-classified. Initial the statement.

- Finally, date your application and add your signature where indicated. Double-check that all fields have been completed without omissions.

- Once you have filled out the form, you have the option to save changes, download, print, or share the document as needed.

Complete your Ati Exemption Application Form online today to ensure you meet the necessary deadlines and secure your exemption.

To qualify for a property tax exemption in California, you must meet the state's criteria based on your property type and personal circumstances. Typically, these can include exemptions for homeowners, veterans, or those with disabilities. Completing the ATI Exemption Application Form is a critical step in this process, and it helps document your eligibility. Following the proper guidelines can lead to significant savings on your property taxes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.