Get Tpt20 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tpt20 Form online

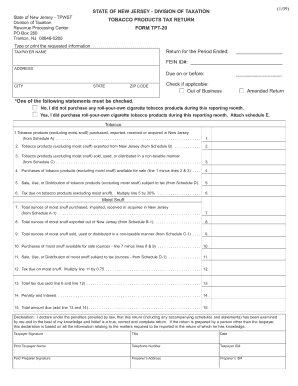

Filling out the Tpt20 form online is an essential task for anyone involved in the tobacco products industry in New Jersey. This guide provides you with clear and supportive instructions for completing the form accurately and efficiently.

Follow the steps to fill out the Tpt20 Form correctly online

- Click 'Get Form' button to obtain the form and open it in the editor.

- Type or print the requested information in the designated fields, including the taxpayer name, FEIN ID, address, city, state, and zip code.

- Check the applicable box if out of business or if you are submitting an amended return.

- Indicate whether you purchased roll-your-own cigarette tobacco products by checking yes or no. If yes, be sure to attach Schedule E.

- Fill in Line 1 with the total wholesale price of tobacco products (excluding moist snuff) purchased or received in New Jersey from Schedule A.

- Complete Line 2 with the total wholesale price of tobacco products (excluding moist snuff) exported from New Jersey based on Schedule B.

- Input the total wholesale price on Line 3 for non-taxable distribution from Schedule C.

- Calculate Line 4 by subtracting the total from Lines 2 and 3 from Line 1 to find the total available for sale.

- Enter the total tobacco products sold subject to tax on Line 5 from Schedule D.

- Calculate tax due on tobacco products for Line 6 by multiplying the total on Line 5 by 30%.

- Fill in Line 7 with the total ounces of moist snuff purchased in New Jersey from Schedule A-1.

- Complete Line 8 with the total ounces of moist snuff exported from New Jersey based on Schedule B-1.

- Input the total on Line 9 for non-taxable distribution of moist snuff from Schedule C-1.

- Calculate Line 10 by subtracting Lines 8 and 9 from Line 7 for the total ounces available for sale.

- Enter the total sold subject to tax on Line 11 from Schedule D-1.

- Calculate tax due on moist snuff for Line 12 by multiplying the total on Line 11 by $0.75.

- Add Lines 6 and 12 together on Line 13 for the total tax due.

- Input any penalties and interest for late returns on Line 14.

- Calculate the total amount due on Line 15 by adding Lines 13 and 14.

- After completing all sections, ensure the form is signed, then save changes, download, print, or share your completed form as needed.

Complete your documents online today for a seamless filing experience.

Filling out the W-8BEN form involves providing basic information such as your name, country of citizenship, and the type of income you're receiving from U.S. sources. You'll also need to declare your foreign tax identification number, if applicable. The Tpt20 Form can support you in navigating these requirements smoothly, ensuring that you complete every section accurately. Properly completed forms expedite any claims for reduced withholding, thereby enhancing your experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.