Loading

Get Appendix 11 Model Mortgage Form 41651 Rev 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Appendix 11 Model Mortgage Form 41651 Rev 2 online

Filling out the Appendix 11 Model Mortgage Form 41651 Rev 2 online can be a straightforward process. This guide provides a step-by-step approach to help users complete the form correctly and efficiently.

Follow the steps to complete the form with confidence.

- Click ‘Get Form’ button to access the Appendix 11 Model Mortgage Form 41651 Rev 2 and open it in the editor.

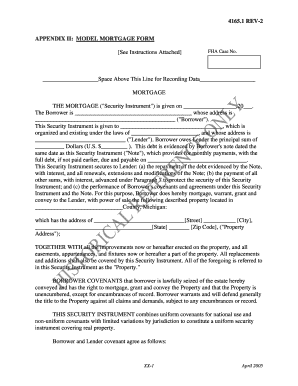

- Begin by entering the FHA Case Number in the designated space at the top of the form.

- Fill in the date when the mortgage is given on the line provided, ensuring to format the date correctly.

- In the Borrower section, write the full name of the Borrower and their complete address. Ensure the information is accurate and clearly written.

- Next, identify the Lender by entering the name of the entity providing the loan, along with their address and state of incorporation.

- Input the principal sum owed to the lender in both written form and numeric form directly below.

- Indicate the date by which the debt must be repaid, as well as the monthly payment terms, and review this section thoroughly.

- Provide property details, including the complete address and county. This includes street, city, state, and zip code.

- Read through the Uniform Covenants section carefully, confirming agreement with terms regarding payments, insurance, and maintenance of the property, then initial as required.

- Finally, complete the Non-Uniform Covenants as needed based on your jurisdiction and any specific conditions relevant to your mortgage.

- At the end of the form, ensure all signature lines are signed and dated accordingly by all parties involved.

- Review the completed form for any errors or omissions, and once satisfied, save your changes, download, print, or share the form as necessary.

Complete your form online today to ensure a smooth mortgage process.

FHA loan requirements: minimum credit score If you want to put just 3.5 percent down, the minimum credit score for a FHA loan is 580. If you can bump up your down payment to at least 10 percent, you can have a credit score as low as 500 and still qualify.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.