Loading

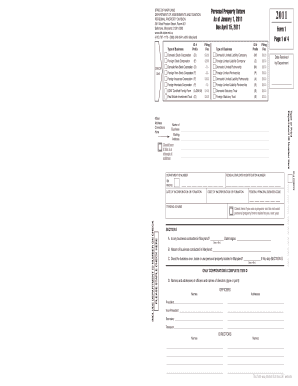

Get Personal Property Return As Of January 1 2011 Due April 15 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Personal Property Return As Of January 1 2011 Due April 15 2011 Form online

Filling out the Personal Property Return is an important step for businesses operating in Maryland. This guide provides clear and detailed instructions to help you complete the form accurately and submit it on time.

Follow the steps to fill out the Personal Property Return online.

- Click the ‘Get Form’ button to obtain the Personal Property Return form and open it in your preferred editor.

- Identify the type of business you are reporting. Enter your business name, mailing address, and confirm if there are any address corrections.

- Fill in your Department ID number and Federal Employer Identification Number. Ensure this is correct for proper processing.

- Select the applicable business type from the options provided and note any associated filing fees.

- Complete Section I, answering if any business is conducted in Maryland, detailing the nature of the business, and confirming ownership or use of personal property located in Maryland.

- If you are a corporation, provide the names and addresses of the officers and directors as required.

- In Section II, report all tangible personal property owned or used in Maryland, including original costs, and address questions related to your business's inventory and the nature of the personal property.

- Review depreciation rates in the provided chart and apply accordingly to your reported assets.

- Complete Section III, providing a gross sales amount and responding to any other relevant questions.

- After thoroughly reviewing all information for accuracy, sign and date the form where indicated.

- Finally, save your changes, and choose to download, print, or share the completed form for submission.

Complete your Personal Property Return form online today to ensure compliance and avoid penalties.

In Maryland, personal property includes tangible items that are not real estate but are used in business operations. This can consist of machinery, equipment, office furniture, and inventory. When filing your Personal Property Return As Of January 1 2011 Due April 15 2011 Form, it is crucial to accurately report all personal property to comply with state regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.