Get Sba Form 2287 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Form 2287 Fillable online

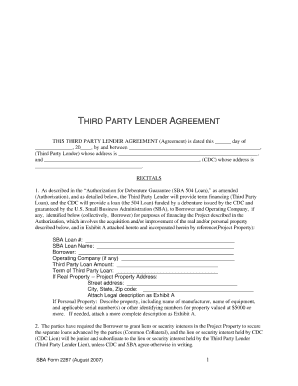

Filling out the Sba Form 2287 Fillable online can streamline your submission process and ensure that all required information is provided accurately. This guide will walk you through the essential steps to properly complete the form and navigate its components effectively.

Follow the steps to successfully complete the Sba Form 2287 Fillable

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by accurately entering your personal information in the designated fields, including your full name, address, and contact details. Make sure to double-check for typos.

- Next, navigate to the financial information section. This requires you to input details related to your income, expenses, and any outstanding debts. Please ensure that your figures are accurate and match any supporting documentation.

- Proceed to any additional questions or declarations that may be present on the form. Read each prompt carefully and provide concise, truthful responses.

- If applicable, attach any required supplemental documents as specified in the form. Ensure that you follow the instructions on how to submit these attachments correctly.

- Once you have completed filling out all sections, review the form for any errors or missing information. Correct any discrepancies before proceeding.

- Finally, save your changes. You can choose to download the completed form, print it for your records, or share it as needed for submission.

Complete your documents online today for a seamless filing experience!

An SBA pre-approval letter is a document that indicates a lender's willingness to provide funding based on a preliminary review of your financial situation. This letter can strengthen your position when negotiating with sellers or landlords, giving you the confidence to move forward. Obtaining this letter often involves detailed financial documentation, which the Sba Form 2287 Fillable can help you compile effectively. By accessing our platform, you can simplify the process of getting your pre-approval letter.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.