Get L1 E 267 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the L1 E 267 Form online

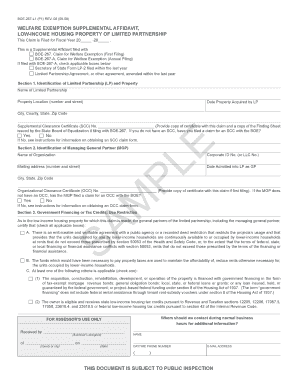

Filling out the L1 E 267 Form online can be a straightforward process if you follow the right steps. This guide provides clear instructions to assist you in accurately completing this important document for the welfare exemption supplemental affidavit for low-income housing properties.

Follow the steps to efficiently complete the L1 E 267 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Clearly identify the limited partnership and property in Section 1. Enter the name of the limited partnership, property location, date acquired, and mailing address. Ensure to provide a Supplemental Clearance Certificate number if applicable.

- Complete Section 2 by identifying the managing general partner. Fill in the organization's name, corporate ID number, and address. Also, provide the date they were admitted as a general partner.

- In Section 3, check applicable boxes regarding government financing or tax credits. Certify that there are enforceable agreements that confirm the property is designated for low-income use.

- Proceed to Section 4 to include household information. Specify the number of persons in each household, their incomes, and indicate which units are reserved for low-income housing.

- In Section 5, confirm the managing general partner's designation and their material participation. Make sure to check the applicable boxes regarding their management duties.

- Fill out Section 6 addressing the delegation of authority, indicating if the managing general partner can delegate duties and provide necessary details.

- Finalize the document in Section 7 by ensuring all general partners certify the information provided. Sign and date the form as required.

- Once the form is completed, make sure to save your changes. You can download, print, or share the completed form as needed.

Start completing your L1 E 267 Form online today to ensure your application is processed efficiently.

If you are a non-U.S. individual or entity receiving income from U.S. sources, completing the W-8BEN form is advisable. This form helps you establish your foreign status and can potentially lower your withholding tax rates. To protect your financial interests and streamline your processes, consider using the US Legal Forms platform for comprehensive support in completing the form correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.