Loading

Get Editable Captive Reit Disclosure Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Editable Captive Reit Disclosure Form online

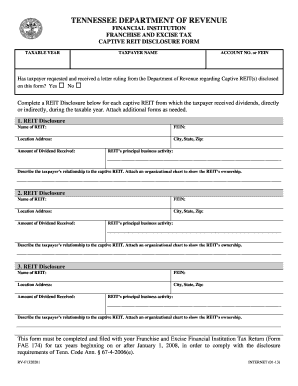

Filling out the Editable Captive Reit Disclosure Form is essential for financial institutions to comply with state tax regulations. This guide provides clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to accurately complete the form online.

- To obtain the form, press the ‘Get Form’ button and open it in your editor.

- Enter the taxable year for which you are completing this disclosure. This is the same period indicated on your Franchise and Excise Financial Institution Tax Return.

- Fill in the taxpayer name with the legal name of the financial institution required to file this form.

- Input the Account No. or FEIN, which is either the nine-digit franchise and excise tax account number or the federal employer identification number of the taxpayer.

- Indicate whether the taxpayer has requested and received a letter ruling from the Department of Revenue regarding the Captive REIT(s) by checking the appropriate box.

- For each captive REIT from which the taxpayer received dividends during the taxable year, complete a REIT Disclosure section. You should provide the legal name, address, and FEIN of each REIT.

- Enter the amount of dividends received directly or indirectly from the captive REIT in the designated field.

- Describe the principal business activity of the REIT in the space provided.

- Detail the taxpayer’s relationship to the captive REIT, including how the REIT is owned, and attach an organizational chart if necessary.

- If multiple REITs exist, repeat steps 6 through 9 for each REIT. Ensure all sections are complete.

- Once all information is entered and reviewed, save your changes. You can then download, print, or share the form as needed.

Complete your documents online today to ensure compliance and avoid penalties.

Forming a REIT involves several steps: creating a corporation, selecting a board of directors, and issuing shares to investors. You must also comply with IRS regulations regarding income distribution and asset management. The Editable Captive REIT Disclosure Form assists in this process by ensuring that you have all the necessary documentation to meet these regulations smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.