Get Ftb 626 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 626 Form online

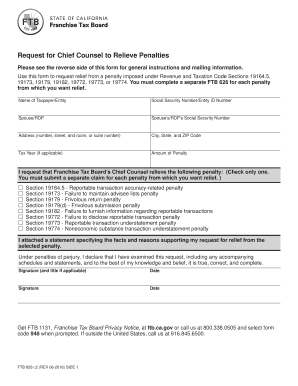

The Ftb 626 Form is used to request relief from penalties imposed under specific California Revenue and Taxation Code Sections. This guide will provide you with clear, step-by-step instructions to fill out this form online, ensuring that you complete each section accurately and efficiently.

Follow the steps to complete your Ftb 626 Form online.

- Click ‘Get Form’ button to access the Ftb 626 Form. Once the form is opened, you can begin filling it out.

- In the ‘Name of Taxpayer/Entity’ field, enter the full name of the individual or business entity requesting penalty relief.

- Provide the Social Security Number or Entity ID Number in the respective field, ensuring accuracy for identification purposes.

- If applicable, include the name and Social Security Number of your spouse or registered domestic partner (RDP).

- Fill in the address, including number, street, room or suite number, city, state, and ZIP code.

- Indicate the tax year relevant to your penalty request in the appropriate section. If this does not apply, you may leave it blank.

- In the ‘Amount of Penalty’ field, specify the total penalty amount from which you are seeking relief.

- Check the box next to the specific section of the Revenue and Taxation Code from which you are requesting relief, ensuring only one box is checked.

- Attach a detailed statement explaining the facts and reasons that support your request for relief from the selected penalty.

- Finally, sign and date the form, ensuring that if a joint request is being made, both parties have signed, or if a business entity is filing, an authorized individual must sign and include their title.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed.

Complete your Ftb 626 Form online today and take the first step towards addressing your penalty relief request.

The California Franchise Tax Board may send you a letter for numerous reasons, including tax discrepancies, updates on your account, or requests for filing the FTB 626 Form. They might also provide information about potential refunds or unpaid taxes. Always respond to these letters to avoid penalties. If you need assistance, platforms like USLegalForms can simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.