Loading

Get Http Editable Keystonecollects Com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Http Editable Keystonecollects Com online

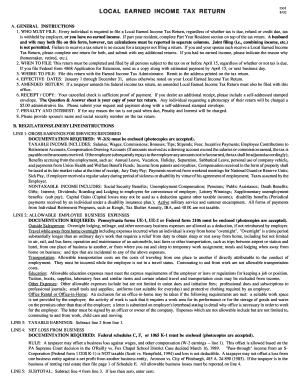

Filling out the Local Earned Income Tax Return can be a straightforward process with the right guidance. This guide provides detailed instructions to help you complete the form accurately and efficiently, ensuring compliance with local tax regulations.

Follow the steps to fill out your Local Earned Income Tax Return online.

- Click ‘Get Form’ button to obtain the Local Earned Income Tax Return and open it in the editor.

- Begin by entering your personal information. Fill in your name, address, city, state, and zip code. If applicable, include your spouse’s name and social security number in the designated fields.

- Indicate if you moved during the tax year by checking the box. Provide the addresses and dates for each residence during the year.

- Report your gross earnings as recorded on your W-2 forms in Line 1. Be sure to enclose photocopies of your W-2s with this return.

- If you have any allowable non-reimbursed employee business expenses, document these on Line 2, and attach the appropriate Pennsylvania forms or federal form 2106.

- Calculate your taxable earnings by subtracting Line 2 from Line 1 and write the result on Line 3.

- If applicable, report any net loss from business on Line 4 with the necessary documentation.

- Subtract the loss reported in Line 4 from the taxable earnings in Line 3 to find your subtotal for Line 5.

- If you have any net profits from business, as documented in Line 6, report this amount and include necessary backup paperwork.

- Combine the totals from Lines 5 and 6 on Line 7 to report your total earned income subject to tax.

- Calculate your tax liability as specified by multiplying Line 7 by the applicable tax rate on Line 8.

- List any quarterly estimated payments made on Line 9, followed by earned income tax withheld as shown on your W-2 on Line 10.

- Include any prior year credit on Line 11 and related miscellaneous credits on Line 12.

- Add up Lines 9, 10, 11, and 12 to get the total of credits on Line 13.

- If you have overpaid your taxes, indicate this on Line 14, selecting between a refund or a credit for next year.

- Calculate any amount of tax due on Line 15 if applicable, along with any interest and penalties that may apply on Line 16.

- Total the amount due on Line 17 and note this total in Box 19, alongside your enclosed payment if applicable.

- Review the form for accuracy, complete your signature and date lines, and ensure all necessary documentation is enclosed.

Complete your Local Earned Income Tax Return online today to ensure timely and accurate filing.

Claiming local taxes typically involves filling out the appropriate tax forms and submitting them to your local tax authority. It's important to maintain detailed records of your income and deductions, which can be streamlined through resources found at Http Editable Keystonecollects Com. Always check for specific instructions from your locality to ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.