Get Drop Distribution Request.indd - Op-f

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DROP Distribution Request.indd - Op-f online

This guide provides a step-by-step approach for users to effectively fill out the DROP Distribution Request form online. Whether you are a member or a survivor, understanding each section of the form will help ensure a smooth submission process.

Follow the steps to complete your DROP Distribution Request online.

- Press the 'Get Form' button to access the DROP Distribution Request form online. This will allow you to open the document and begin filling it out in an electronic format.

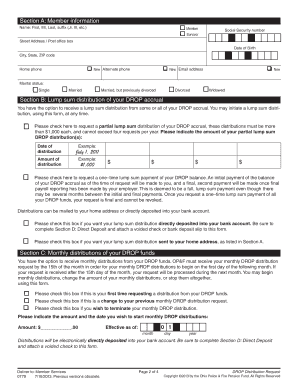

- Section A requires you to provide your personal information. Indicate whether you are a member or a survivor, and fill in your full name, Social Security number, date of birth, address, and contact details. Select your marital status from the available options.

- In Section B, choose whether you are requesting a partial lump sum distribution or a one-time lump sum payment of your DROP balance. Make sure to specify the amounts and distribution dates as required.

- For Section C, specify if this is your first time requesting monthly distributions or if you are changing or terminating an existing distribution. Indicate the desired amount and effective date for monthly distributions.

- Complete Section D to provide your Direct Deposit information. Specify your bank account type, enter the bank's routing and account numbers, and attach a voided check to enable direct deposit.

- In Section E, decide if you want to withhold any state income tax from your DROP distribution. Mark your selection and specify the amount or percentage to be withheld.

- Section F allows you to choose a direct rollover option for your DROP funds. Indicate the account type for the rollover and fill in the required details of the financial institution managing the account.

- Sections G and H require your signature and date, and if applicable, the notarization of your signature. Ensure all information is accurate before submission.

- If you are married, your spouse must fill out Sections I and J. They should sign and date the form in acknowledgement of the DROP distribution request.

- Finally, review the completed form for accuracy. Save your changes, and proceed to download, print, or share the form as needed before submission.

Complete your DROP Distribution Request online today to ensure timely processing of your funds.

The interest rate on a pension fund typically reflects the returns generated from its investments and can vary widely among different funds. Pension funds generally aim to provide a stable return that adjusts for inflation over time. It's essential to consider these rates when evaluating your retirement options, including DROP programs. For detailed insights and assistance regarding your DROP Distribution Request.indd - Op-f, visit uslegalforms for comprehensive support.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.