Loading

Get N 110 Hawaii Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the N 110 Hawaii Form online

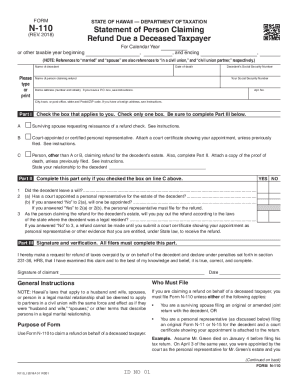

Filling out the N 110 Hawaii Form is an important process for individuals claiming a refund on behalf of a deceased taxpayer. This guide will provide you with clear, user-friendly steps to complete the form online.

Follow the steps to successfully complete the N 110 Hawaii Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the decedent's name, date of death, and Social Security number in the designated fields.

- Provide your name as the person claiming the refund along with your Social Security number.

- Fill in your home address, including street number and name. If you have a P.O. box, ensure to follow the specific instructions provided.

- Indicate your city, town, or post office, along with your state and postal/ZIP code. For foreign addresses, follow the instructions for formatting.

- Check the appropriate box that applies to your situation: A for surviving spouse, B for court-appointed representative, or C for another person, ensuring to complete the necessary sections based on your choice.

- If you selected box C, answer the questions in Part II regarding the will and personal representative appointment, providing truthful responses.

- In Part III, include your signature and the date, confirming that the request for refund is accurate to the best of your knowledge.

- Once you have reviewed all entered information, save your changes, then download, print, or share the completed form as needed.

Start completing your documents online today for a seamless filing experience.

Hawaii Form N11 is the main income tax form for residents in Hawaii. It is used to report statewide earnings, allowing residents to claim various deductions and credits. Utilizing the N 110 Hawaii Form can help you navigate the complexities of tax filing in the state, ensuring that all necessary information is accurately reported. If you are a resident, completing this form is essential for your tax responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.