Get Subordination Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Subordination Agreement online

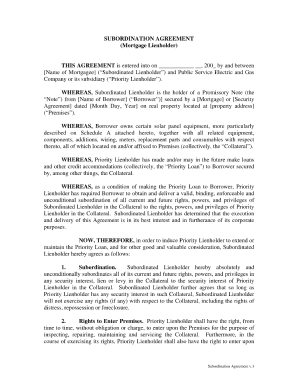

A subordination agreement is an essential legal document that outlines the priority of loans in the case of default. Filling out this form online can streamline the process and ensure that all necessary information is captured accurately.

Follow the steps to complete your Subordination Agreement online.

- Click the ‘Get Form’ button to access the Subordination Agreement form and open it in the online editor.

- Read the introductory section of the form carefully. This section typically defines the parties involved and explains the purpose of the agreement. Make sure you understand the implications before proceeding.

- Fill in the details of the parties involved. This includes the name and address of each lender and borrower. Ensure accurate spelling and contact information to avoid future complications.

- Specify the loan amounts and terms. Clearly state the principal amounts for each loan, as well as any interest rates or unique conditions attached to the loans.

- Indicate the subordination terms. This section details the conditions under which one loan is subordinate to another. Make sure to review this carefully as it could significantly impact the rights of the lenders.

- Review any additional clauses or conditions. This may include foreclosure terms or payment schedules. It is vital to ensure that all parties understand and agree to these terms.

- Sign and date the agreement. Ensure that all necessary parties sign where indicated, and include the date of signing for record-keeping purposes.

- After completing the form, you will have the option to save changes, download, print, or share the final document. Choose the appropriate option based on your needs.

Complete your Subordination Agreement online today to ensure a smooth process.

Requirements for a subordination agreement include legal identification of all parties, a clear description of loans being subordinated, and the specific terms of the agreement. It usually must be signed by both the borrower and lender, and often requires notarization to be valid. Meeting these requirements is crucial to ensure the enforceability of the subordination agreement. Leaning on resources like US Legal Forms can help you meet these requirements efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.