Loading

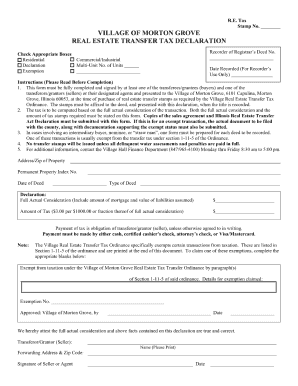

Get Morton Grove Transfer Declaration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Morton Grove Transfer Declaration Form online

The Morton Grove Transfer Declaration Form is an essential document for individuals looking to manage property transactions effectively. This guide will provide clear, step-by-step instructions to help users complete the form online.

Follow the steps to fill out the Morton Grove Transfer Declaration Form with ease.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by entering the current owner's information, which typically includes their full name and contact details. Ensure accuracy, as this information is crucial for the transfer process.

- Next, provide the property details, including the address and legal description. This section may require you to look up your property's specifics, so have that information ready.

- In the transfer section, clearly indicate the intended new owner's name and contact information. It's important to ensure that all names are accurate to avoid future complications.

- For any additional considerations, review the relevant boxes regarding the type of transfer being made, such as whether it is a gift or sale. Select the appropriate option that reflects your situation.

- Once all sections are completed, review the entire form for any errors or missing information. This step is crucial to ensure the smooth processing of your declaration.

- Finally, you can save your changes, download the completed form, print it, or share it as needed. Make sure to keep a copy for your records.

Take control of your property management by filling out the Morton Grove Transfer Declaration Form online today.

Yes, Will County imposes a transfer tax on real estate transactions. The rate can vary, and both buyers and sellers should be aware of any specific tax obligations. When filing the Morton Grove Transfer Declaration Form, be sure to include information regarding the transfer tax to avoid any potential issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.