Get Form Of Performance Bond

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Of Performance Bond online

Filling out the Form Of Performance Bond is an important step in ensuring compliance with contract obligations. This guide provides clear and concise instructions on how to complete the form online, making the process as straightforward as possible for all users.

Follow the steps to successfully complete your performance bond form

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

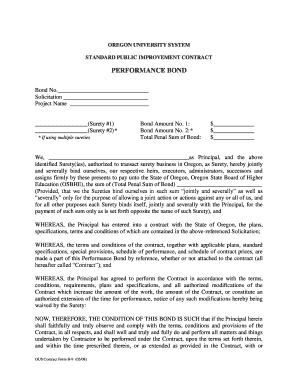

- Enter the bond number in the designated field at the top of the form. This unique identifier is essential for tracking the bond.

- Fill in the solicitation number, which relates to the specific project or contract associated with this bond.

- Provide the name of the project in the corresponding field to ensure it is clearly linked to the contract.

- If using multiple sureties, list the names of all sureties in the specified fields. Otherwise, enter only the primary surety.

- Enter the bond amounts for each surety, if applicable, and ensure that the total penal sum of the bond is accurately calculated and filled in.

- In the section beginning with 'We,' enter the name of the principal responsible for the contract along with any required signatures or information.

- Confirm the legal compliance by reviewing the terms and conditions stated in the bond, ensuring that all obligations from the contract are acknowledged.

- Complete the signature area for the principal, including the date and the official capacity of the person signing.

- If applicable, add signatures for each surety and ensure that the power-of-attorney documentation accompanies each surety bond.

- Once all fields are filled out accurately, save changes to the document, and proceed to download, print, or share the completed form as necessary.

Start completing your Performance Bond form online today to ensure your contract obligations are met.

Get form

The two main types of bonds are surety bonds and insurance bonds. Surety bonds guarantee that the contractor will fulfill their contractual duties, while insurance bonds protect against financial loss related to project risks. Both types serve unique purposes in safeguarding interests and managing risk in contracts. Selecting the right form of performance bond or bond type is essential for achieving security and peace of mind in your projects.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.