Get Substitute W 9 For Oregon State University Form - Oregonstate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute W 9 For Oregon State University Form - Oregonstate online

This guide provides a comprehensive overview of how to accurately complete the Substitute W 9 Form for Oregon State University online. Whether you are a vendor or individual needing to receive payments, these straightforward steps will assist you in filling out the form correctly.

Follow the steps to successfully complete your Substitute W 9 Form.

- Click 'Get Form' button to obtain the form and open it for editing.

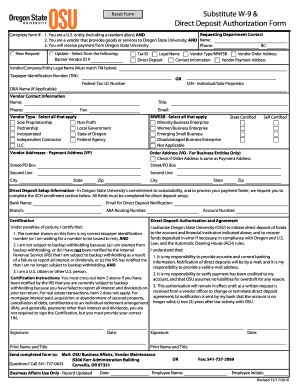

- Begin by selecting either 'New Request' or 'Update' at the top of the form. If selecting 'Update,' provide your Vendor ID Number if you have it.

- In the main section, enter your entity's Legal Name as it appears on your IRS documents, followed by the corresponding Taxpayer Identification Number.

- If you operate under a different business name (Doing Business As), enter that name in the DBA field. If not, leave this field blank.

- Provide your entity's Contact Information, including name, phone number, title, fax, and email.

- For the Vendor Type and MWESB sections, select all applicable options that describe your entity.

- Complete your entity's Payment Address and Order Address. If these addresses are the same, check the box indicating so.

- In the Direct Deposit Setup Information section, provide the required banking details including Bank Name, ABA Routing Number, and Account Number.

- Both a company officer's signature and printed name/title are necessary for the W-9 Certification and Direct Deposit Authorization sections.

- Once completed, save your changes, download the document, and print for a physical signature.

- Lastly, send the completed form to the OSU Business Affairs, Vendor Maintenance via mail or fax as instructed on the document.

Complete your Substitute W 9 Form online today to ensure timely processing of your payments at Oregon State University.

A substitute W9 is specifically designed to collect taxpayer information from individuals who are not corporate entities. It helps organizations, like Oregon State University, obtain accurate tax identification for reporting purposes. By filling out the Substitute W 9 For Oregon State University Form - Oregonstate, you support timely and correct tax filings and facilitate your payment processes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.