Get Application For A Tax Id Number

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For A Tax Id Number online

Filling out the Application For A Tax Id Number online is an essential step for individuals and entities seeking to comply with federal tax regulations. This guide will provide you with detailed instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the form online with ease.

- Click ‘Get Form’ button to obtain the form and open it in your digital editor.

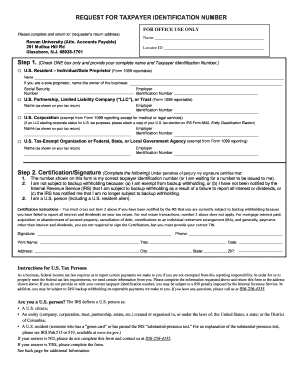

- Carefully review the first section of the form to determine your status. Check ONE of the boxes provided for your specific classification: U.S. Resident – Individual/Sole Proprietor, U.S. Partnership, LLC, or Trust, U.S. Corporation, or U.S. Tax-Exempt Organization. Ensure to provide your complete name and corresponding Taxpayer Identification Number (TIN) as required in the section.

- Complete the Certification section. Under penalties of perjury, you must include your signature certifying the correctness of the TIN provided. Ensure to respond to all certification requirements, especially regarding backup withholding.

- Provide your contact information, including your phone number, printed name, title (if applicable), and your complete address including city, state, and ZIP code.

- Verify all provided information for accuracy, ensure that every section is filled out. Pay attention to detail to avoid potential penalties for incorrect information.

- Finally, save your changes, and you may then choose to download, print, or share the completed form as necessary.

Start completing your Application For A Tax Id Number online today.

The time it takes to receive your US tax number can vary, but with the right steps, you can expedite the process. Generally, if you submit your Application For A Tax Id Number online, you may receive your number within a day. However, if you apply via mail, it could take several weeks. Using platforms like US Legal Forms can help ensure all your application details are accurate, leading to a quicker response.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.