Loading

Get Ft 1120

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ft 1120 online

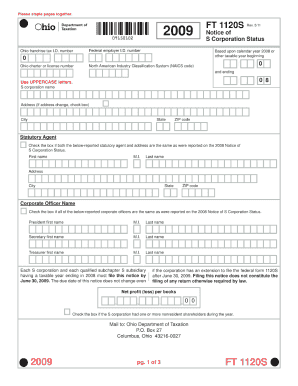

Filling out the Ft 1120 form online can be a straightforward process with the right guidance. This guide provides step-by-step instructions to help you successfully complete each section and field of the form.

Follow the steps to complete the Ft 1120 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the instructions provided on the form to ensure you understand the requirements for your specific filing situation. Take note of any additional documentation that may be required.

- Fill out basic information, including the name of the partnership, employer identification number, and the address. Be sure to input accurate information to avoid issues later.

- Complete the section related to income, detailing all sources of income for the reporting period. Ensure you use correct amounts and categories as outlined in the form.

- Fill in the deductions section carefully. List all relevant deductions that apply, which will help reduce your taxable income. Double-check each entry for accuracy.

- Review the schedule for tax computation, ensuring that you compute the taxes owed correctly. Use relevant forms and documentation to back up your calculations.

- Once all sections are filled out, review the entire form for completeness and accuracy. Make sure that all required signatures are included if necessary.

- After reviewing, save your changes. You may choose to download, print, or share the completed form as needed.

Start filing your Ft 1120 form online today!

To write out 1120, you express it as 'one thousand one hundred twenty.' This method of writing numbers helps ensure clear understanding in written communications. When dealing with forms like the Ft 1120, precise numbers enhance accuracy in reporting. Always strive for clarity in your documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.