Loading

Get Mo Nrs Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Nrs Form online

Filling out the Mo Nrs Form online can streamline your documentation process and ensure accurate reporting of income for nonresident shareholders. This guide provides clear steps for completing the form effectively.

Follow the steps to easily complete the Mo Nrs Form online.

- Click the ‘Get Form’ button to access the Mo Nrs Form and open it in your desired editor.

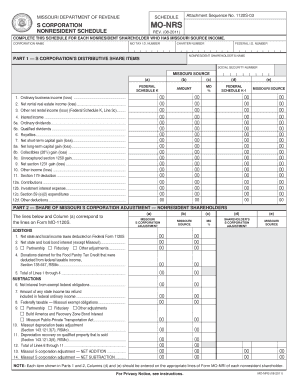

- Begin by entering the corporation name, MO Tax I.D. number, charter number, and federal I.D. number in the designated fields at the top of the form.

- Input the nonresident shareholder’s name and Social Security number as provided in the Federal Form 1120S, Schedule K-1.

- In Part 1, list the S corporation’s distributive share items. For each item, refer to the Federal Schedule K for amounts due. Ensure that the information is from accurate Missouri source calculations.

- In Part 2, for each nonresident shareholder, record the Missouri S corporation adjustments. The amounts listed must correspond to the appropriate adjustive lines indicated.

- Verify all entries for accuracy and completeness, ensuring that totals are calculated correctly in corresponding columns.

- Once finished, save any changes made to the form. Users can then download, print, or share the form as needed.

Complete your documents online and simplify your filing process today.

When submitting a Missouri tax return, include all necessary forms that support your income claims, deductions, and credits. Essential forms typically consist of W-2s, 1099s, and any other income statement forms you received. By organizing these documents effectively, you make the review process smoother and improve the accuracy of your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.