Loading

Get Form 706 Ce

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 706 Ce online

Filling out the Form 706 Ce online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form to ensure that you provide accurate information and complete your filing efficiently.

Follow the steps to fill out the Form 706 Ce correctly.

- Click ‘Get Form’ button to open the form in your preferred online platform.

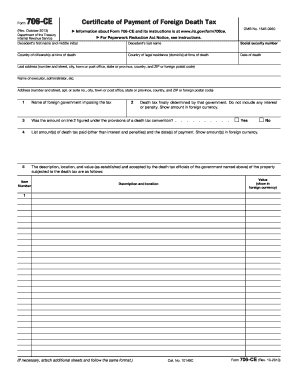

- Begin by entering the decedent’s first name, middle initial, and last name in the designated fields. Ensure accuracy as this information is essential.

- Next, provide the decedent's social security number, country of citizenship at the time of death, and their date of death. This ensures proper identification of the estate.

- Enter the country of legal residence (domicile) at the time of death along with the last address. Include complete details — number and street, city, state, and ZIP code.

- Fill in the name of the executor or administrator responsible for handling the estate, followed by their address in the required format.

- Identify the foreign government imposing the tax, along with the amount of death tax determined by that government as shown on line 2. Do not include interest or penalties.

- Indicate whether the amount on line 2 was calculated under the provisions of a death tax convention by selecting 'Yes' or 'No'.

- List amounts of death tax paid (excluding interest and penalties) along with the corresponding dates of payment, showing sums in foreign currency.

- Describe the property subjected to the death tax, noting each item’s number, details, location, and value in the appropriate fields.

- State whether any refund of part or all of the death tax has been claimed or allowed, and provide details if applicable.

- Upon completing the form, review all entries for accuracy before saving your changes. You will have the option to download, print, or share the filled form as needed.

Start your document filing today by completing the Form 706 Ce online.

The 706 code on a tax transcript indicates that a Form 706 related to an estate tax return has been filed. This code helps track estate tax matters through the IRS. If you need assistance navigating your estate tax filings, platforms like USLegalForms can provide valuable resources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.