Get Form G 4 Rev 1209

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

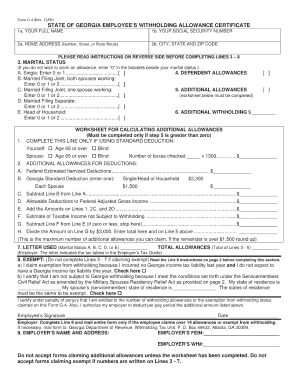

How to fill out the Form G 4 Rev 1209 online

Filling out the Form G 4 Rev 1209 online can streamline your application process. This guide will provide you with clear, step-by-step directions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the Form G 4 Rev 1209 with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your full name in the designated field. Ensure that the name matches your official documents for consistency.

- In the next section, provide your mailing address, including street number, street name, city, state, and ZIP code. Double-check for accuracy to avoid issues with correspondence.

- Next, you will find fields asking for your contact information. Enter your phone number and email address so that the authorities can reach you if needed.

- Follow this by completing the section regarding your immigration status. Select the appropriate status from the options provided and ensure that it accurately reflects your situation.

- Proceed to the section where you need to specify your reason for filing this form. Clearly articulate your reasoning, as this may impact the processing of your application.

- Finally, review all the information you have entered. Make any necessary corrections before proceeding to save your changes. You can download the completed form, print it, or share it as needed.

Take the next step and fill out your Form G 4 Rev 1209 online today!

To file form no 10IEA, start by gathering all necessary information required for the submission, including personal details and relevant financial data. Ensure you have the correct version and format of the form, such as Form G , which may be needed for related submissions. You can complete the form online for convenience or print it for manual submission, making sure to follow the local filing instructions provided by the state. Using a reliable platform like uslegalforms can simplify this process, helping you to fill out the form accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.