Get Emints Metrorevenue Org Exportview Doc H

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Emints Metrorevenue Org Exportview Doc H online

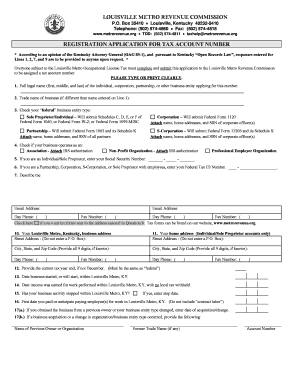

The Emints Metrorevenue Org Exportview Doc H is a crucial form for individuals and businesses subject to the Louisville Metro Occupational License Tax. This guide will provide you with a step-by-step approach to completing this form correctly and efficiently online.

Follow the steps to fill out the Emints Metrorevenue Org Exportview Doc H effectively.

- Click ‘Get Form’ button to access the document and open it in your preferred editor.

- In Line 1, enter the full legal name of the individual, corporation, partnership, or other business entity applying for the tax account number. Make sure to provide the first, middle, and last names as applicable.

- In Line 2, indicate the trade name of the business if it differs from the name provided in Line 1.

- In Line 3, check the appropriate box to select your federal business entity type. Options include Sole Proprietor, Corporation, Partnership, or S-Corporation. Remember to attach necessary documentation for your entity type if applicable.

- Line 4 requires you to check if your business operates as an Association, Non-Profit Organization, or Professional Employer Organization, and to attach IRS authorization as necessary.

- If you are a Sole Proprietor, proceed to Line 5 to enter your Social Security Number. For Partnerships, Corporations, or S-Corporations with employees, enter your Federal Tax ID Number in Line 6.

- In Line 7, describe the primary business activity you are conducting. Provide clear details about the work or business services.

- Line 8 is for your mailing address for tax forms and correspondence. Input the street address clearly.

- In Line 9, provide your primary business address. Do not use a P.O. Box and include the city, state, and nine-digit zip code.

- Continue to input your email address and day phone number in the designated fields on the form.

- In Line 10, input your Louisville Metro, Kentucky business address, making sure to follow the same guidelines as in Line 9.

- Line 11 is specifically for the home address if you are a Sole Proprietor. Enter this information accurately as well.

- Provide the current tax year end in Line 12, which should match your federal tax year end.

- In Line 13, indicate the date your business started or will start operations within Louisville Metro, KY.

- Line 14 requires you to document any income earned from work performed within Louisville Metro, KY, if applicable.

- In Line 15, indicate if your business activity has stopped within Louisville Metro, KY, and provide the stop date if applicable.

- For Line 16, enter the first date you paid or will anticipate paying employees for work in the area. Do not include contract labor.

- Complete Line 17(a) if you obtained the business from a previous owner or if there has been any organizational change, detailing the date.

- In Line 17(b), provide information about the previous owner or organization and any former trade names, if applicable.

- Once all sections are completed, review the form for accuracy. Save your changes, and then proceed to download, print, or share the completed form as needed.

Complete your Emints Metrorevenue Org Exportview Doc H online today to ensure compliance with the Louisville Metro Occupational License Tax.

Related links form

The Louisville occupational license tax is imposed on individuals and businesses operating within the city, generating revenue for local services. This tax is essential for maintaining community programs and public amenities. Understanding the structure and requirements of this tax is crucial for compliance and financial planning. Resources like Emints Metrorevenue Org Exportview Doc H provide clarity and guidance on occupational license tax obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.