Get Schedule Nd-1nr - Tax Calculation For Nonresidents And Part-year ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule ND-1NR - Tax Calculation For Nonresidents And Part-year residents online

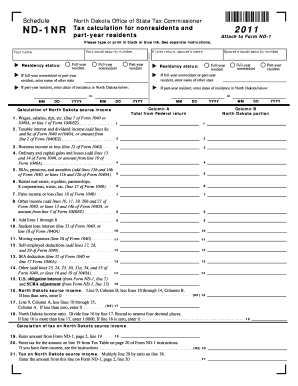

This guide provides a clear and comprehensive overview of how to properly fill out the Schedule ND-1NR form online. Designed for nonresidents and part-year residents of North Dakota, this step-by-step approach will help you understand each section and field of the form.

Follow the steps to fill out the Schedule ND-1NR form correctly.

- Click ‘Get Form’ button to download the form and open it for editing.

- Begin by entering your name and social security number at the top of the form. If you are filing jointly, include your partner's name.

- Indicate your residency status by selecting either ‘Full-year resident,’ ‘Full-year nonresident,’ or ‘Part-year resident.’ If applicable, provide the name of the other state in which you were a resident.

- If you are a part-year resident, input the specific dates of your residency in North Dakota.

- Complete Column A by transferring amounts from your federal income tax return into the appropriate fields.

- In Column B, fill out the amounts reportable to North Dakota according to the detailed instructions provided for each line.

- Calculate your North Dakota source income by subtracting any non-applicable amounts from those reported in Column A.

- Proceed to calculate the tax based on your North Dakota source income, following the designated lines to ensure accuracy.

- After filling out all sections, review the form for any errors or omissions.

- You may then save the changes, download or print the completed form, or share it as required.

Complete your Schedule ND-1NR tax form online today for accurate and efficient filing.

North Dakota has a progressive income tax structure with rates ranging from 1.1% to 2.9%. Rates depend on your taxable income level, which can impact your final tax liability. Being informed about these rates is vital for non-resident aliens to avoid overpayment or underpayment. The Schedule ND-1NR - Tax Calculation For Nonresidents And Part-year allows you to correctly assess how much tax you owe.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.