Loading

Get Offer Of Compromise Form Ga

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Offer Of Compromise Form Ga online

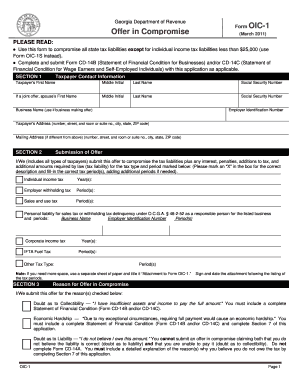

The Offer Of Compromise Form Ga allows taxpayers to propose a settlement for their state tax liabilities. This guide provides a clear, step-by-step approach to filling out this form online, ensuring you understand each part of the process.

Follow the steps to fill out the Offer Of Compromise Form Ga effectively.

- Click ‘Get Form’ button to access the Offer Of Compromise Form Ga and open it in your online editor.

- Provide your taxpayer contact information by filling in your first name, middle initial, last name, and social security number. If applicable, include your spouse's information as well.

- Complete Section 2 by marking the type of tax liability you are compromising. Fill in the respective tax periods and, if needed, attach additional sheets for more periods.

- In Section 3, choose the reason for your offer in compromise. Any selected reason must be accompanied by the necessary Statement of Financial Condition forms (CD-14B and/or CD-14C) or Section 7 explanations.

- Move to Section 4, where you indicate whether you have included the $100 application fee. If not, ensure to fill out Form OIC-1A for income certification regarding the fee.

- In Section 5, specify your offer amount and the payment structure—either a lump sum or a short-term deferred payment option. Detail the payment amounts and terms according to the selected option.

- Outline the source of funds in Section 6, explaining how you will acquire the funds for your offer.

- In Section 7, describe any circumstances you feel justify your offer. Be thorough and attach documentation when necessary.

- Review and sign Section 8, where you agree to the terms and conditions of your offer. Ensure to include the date and your contact information.

- If someone else prepared the form for you, fill in their details in Section 10. Check off if you want to permit another person to discuss your offer in Section 11, providing their contact details if applicable.

- Finally, save your changes, and you have the option to download, print, or share the completed form as needed.

Complete your Offer Of Compromise Form Ga online today for an efficient resolution of your tax liabilities.

Georgia can collect back taxes for up to six years from the date of assessment. After this period, the collection of these debts is typically barred. However, if you make payments or communicate about your tax debts, this timeframe may be extended. If you face difficulties with back taxes, consider submitting an Offer Of Compromise Form GA to potentially resolve your obligations more swiftly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.