Loading

Get Mass Form 2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mass Form 2 online

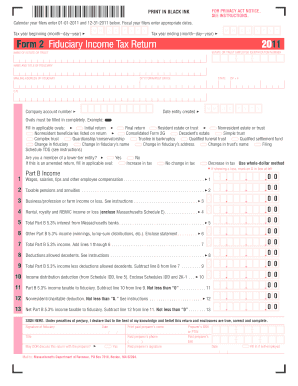

This guide provides comprehensive step-by-step instructions for completing the Mass Form 2 online. With clear guidance on each section, users can confidently fill out this fiduciary income tax return for estates or trusts.

Follow the steps to effectively complete the Mass Form 2 online.

- Press the ‘Get Form’ button to access the document and open it in your preferred online editor.

- Enter the tax year information: fill in the tax year beginning and tax year ending dates accurately.

- Input the estate or trust's employer identification number, and clearly write the name of the estate or trust.

- Fill in the name and title of the fiduciary, alongside their mailing address, including city, state, and ZIP + 4.

- Complete the 'Company account number' and the 'Date entity created' fields.

- For the filing status, fully shade the appropriate ovals: Initial return, Final return, Resident estate or trust, and others as applicable.

- Proceed to Part B for income declaration: accurately report funds such as wages, pensions, business income, and any rental income.

- Calculate total income and deductions allowed; ensure to subtract correctly to find the net taxable income.

- Sign the form under penalties of perjury, providing the fiduciary's signature and date. If applicable, fill in the preparer's information.

- Finally, review all entries, save your changes, download, print, or share the completed form as needed.

Complete your Mass Form 2 online today to ensure timely submission!

A schedule 2 form is typically an additional form used to report specific types of income or deductions that are not covered in the main Form 2. For Massachusetts taxpayers, this might include details about certain credits or adjustments. It’s important to consult the guidelines for MA Form 2 to determine if you need to include schedule 2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.