Get Electronic Filing Of Fiduciary Returns 541 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Electronic Filing Of Fiduciary Returns 541 Form online

Filling out the Electronic Filing Of Fiduciary Returns 541 Form online can seem daunting, but with clear guidance, you can navigate the process with confidence. This guide provides detailed instructions to help you complete each section of the form efficiently, ensuring that your fiduciary tax return is filled out accurately.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

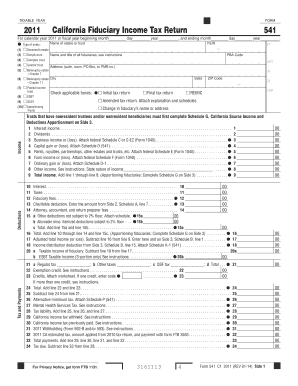

- Begin by entering the taxable year for which you are filing, indicating either the calendar year or the fiscal year with the appropriate start and end dates.

- Select the type of entity by checking the applicable box. Options include decedent’s estate, simple trust, complex trust, grantor trust, bankruptcy estate, pooled income fund, ESBT, and QSST.

- Fill in the name of the estate or trust and provide the Federal Employer Identification Number (FEIN).

- Complete the address section, ensuring to include suite or room numbers, city, state, and ZIP code.

- Determine if this is an initial, final, amended, or change in fiduciary’s name or address by checking the relevant boxes.

- Input income details in the provided fields, including interest, dividends, business income, capital gains, and others as applicable. Ensure you attach any necessary schedules.

- Calculate total income by adding lines for all income entries.

- Proceed to deductions, entering amounts for fiduciary fees, charitable deductions, and any other applicable deductions.

- Once all fields are completed and double-checked for accuracy, save your changes, then download, print, or share the form as required.

Start completing your Electronic Filing Of Fiduciary Returns 541 Form online today!

To download the pre-filled Income Tax Return (ITR) form, visit the appropriate tax authority's website. Look for the section dedicated to the Electronic Filing Of Fiduciary Returns 541 Form, as it usually offers the pre-filled version for convenience. This pre-filled form simplifies your filing process by providing basic information. For a user-friendly experience, uslegalforms offers services that help streamline downloading and filing your forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.