Loading

Get Form K 60

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form K 60 online

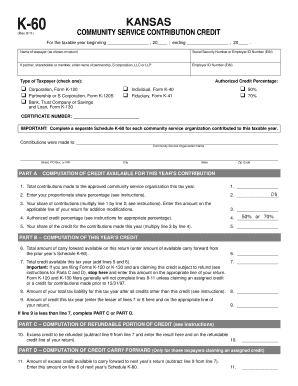

Filling out the Form K 60 is an essential step for those contributing to approved community service organizations in Kansas. This guide provides a clear and user-friendly overview of each section of the form, ensuring that users can complete it accurately and efficiently.

Follow the steps to successfully complete the Form K 60 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year information at the beginning of the form, indicating the start and end dates for the year in question.

- Provide the name of the taxpayer as shown on the income tax return, along with the corresponding Social Security Number or Employer Identification Number (EIN).

- If applicable, specify the name of the partnership, S corporation, LLC, or LLP. Include its EIN for accurate identification.

- Select the type of taxpayer by checking the appropriate box: Corporation, Partnership or S Corporation, Individual, or Fiduciary.

- Indicate the authorized credit percentage that applies to your contributions (50% or 70%).

- Fill in the certificate number for the credit if you have one.

- Detail the community service organization you contributed to, including the name, address, city, state, and zip code.

- Proceed to Part A – Computation of Credit Available for This Year’s Contribution. Enter total contributions made in line 1.

- Input your proportionate share percentage in line 2, reflecting your ownership interest.

- Calculate your share of contributions by multiplying line 1 by line 2 and inputting this amount in line 3.

- Specify the authorized credit percentage in line 4.

- Calculate your share of the credit for contributions and enter this in line 5.

- Complete Part B – Computation of This Year’s Credit. Enter any prior year carry forward in line 6.

- Add the total from line 5 and line 6 to find the total credit available this year. Enter this in line 7.

- Determine the total amount of tax liability after all credits in line 8.

- Enter the lesser of lines 7 or 8 in line 9.

- If necessary, complete Part C or Part D based on your claims.

- Finally, review all entries for accuracy. Save changes, and proceed to download, print, or share the document as needed.

Complete your Form K 60 online today and ensure your contributions are properly credited.

Submitting a K1 form typically involves checking that the form is filled out correctly before submission. Ensure that all required signatures and dates are included to avoid delays. Many users find submitting through a service like UsLegalForms beneficial, as it provides a clear path for successful submission of K1 forms as well as Form K 60.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.