Loading

Get Nyc 400 Form 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc 400 Form 2012 online

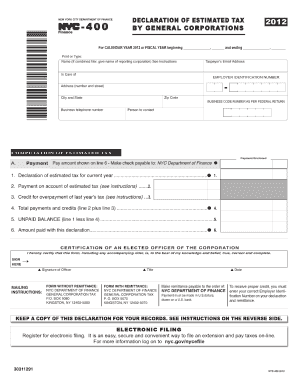

The Nyc 400 Form 2012 is essential for various tax-related tasks in New York City. This guide will walk you through the process of completing the form online, ensuring you can submit your information accurately and efficiently.

Follow the steps to complete the Nyc 400 Form 2012 online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This typically includes your name, address, and identification number. Make sure to double-check for accuracy.

- Proceed to the section related to your income sources. You will input specific amounts corresponding to various categories. Ensure you have your income documents handy for reference.

- Fill out the deductions and credits section, if applicable. You will need to provide details of any deductions you are claiming by entering the required amounts in the provided fields.

- Review all the information entered in the form carefully to ensure that there are no errors or omissions. This step is crucial for preventing delays in processing your form.

- Once you have verified all entries, you can save your changes, download the form in your preferred format, print it for your records, or share it as necessary.

Start completing your Nyc 400 Form 2012 online today to ensure timely submission.

Related links form

The top 1% engages in various strategies that can lead to significant tax savings, estimated in the billions. Many utilized loopholes in the system to minimize liabilities rather than outright evasion. By using detailed reporting methods, including the Nyc 400 Form 2012, they can achieve full compliance while managing their tax responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.