Get 3885l 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3885L 2010 Form online

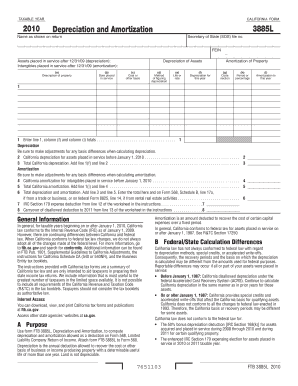

The 3885L 2010 Form, also known as the Depreciation and Amortization form, is essential for computing the deductions for depreciation and amortization as required by California tax law. This guide provides a clear and supportive step-by-step approach to help you complete the form online with ease.

Follow the steps to accurately complete the 3885L 2010 Form online.

- Click ‘Get Form’ button to obtain the 3885L 2010 Form and open it for online editing.

- In the first section, enter the name as shown on your return and include your Secretary of State file number and Federal Employer Identification Number (FEIN).

- Begin listing the assets placed in service after December 31, 2009, under the depreciation section. Fill in the description of the property, the date placed in service, the cost or other basis, the method of figuring depreciation, the life or rate, and the depreciation amount for the current year.

- For the amortization section, provide details about any intangibles placed in service after December 31, 2009. Follow the same format as for the asset section, specifically noting the code section and amortization period or percentage.

- Calculate the totals for columns related to depreciation and amortization, and enter these totals in the designated lines. Ensure any necessary adjustments for basis differences are considered.

- Complete the additional calculations as outlined for total California depreciation and amortization for assets prior to January 1, 2010, by referencing the provided guidelines in the form instructions.

- Finish by reviewing all entries for accuracy, saving all changes, and then downloading, printing, or sharing the completed form as required.

Start filling out the 3885L 2010 Form online today to ensure accurate depreciation and amortization reporting.

To fill out a tax exemption, first determine which specific form applies to your situation, including state-specific rules. Collect necessary information such as your name, address, and tax identification number. Clearly outline your reasons for claiming the exemption, and include any required documentation. US Legal Forms can provide helpful templates and instructions to facilitate the completion of your tax exemption forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.