Loading

Get Tax Upnicin Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Upnicin Form online

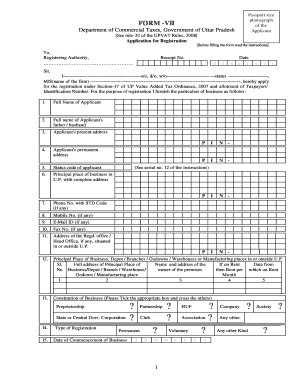

Filling out the Tax Upnicin Form is a crucial step for businesses seeking registration under the Uttar Pradesh Value Added Tax Ordinance. This guide provides clear instructions for accurately completing the form online, catering to users with varying levels of experience.

Follow the steps to complete your Tax Upnicin Form online.

- Click the ‘Get Form’ button to obtain the Tax Upnicin Form and open it in a digital editor.

- Begin filling in your full name in the designated field. Ensure that you use capital letters as required.

- Next, provide your father’s or partner’s full name, selecting the appropriate options to define your status.

- Input your present address, ensuring it is complete and accurate.

- Enter your permanent address, following the same standards of completeness.

- Select the status code for your application by checking the appropriate box in the form.

- Complete the field for your principal place of business in Uttar Pradesh, including a complete address.

- Provide your contact information, including phone number with STD code, mobile number, email ID, and fax number if applicable.

- List the registered office address, including any branches or warehouses in or outside of Uttar Pradesh.

- Indicate the constitution of your business by ticking the relevant box and crossing out the others.

- Select the type of registration needed for your business, ensuring correct matching.

- For nature of business, tick the appropriate categories that describe your operations.

- Detail your financial and bank account information, including the estimated annual turnover.

- Prepare necessary annexures, ensuring all required supporting documents are attached as outlined.

- Review the form for accuracy before submitting it to the registering authority.

- Finally, save your changes, and you can either download, print, or share the completed form as needed.

Get started with completing your Tax Upnicin Form online today!

Related links form

Setting up your tax withholding properly involves understanding your income, existing tax situation, and planned deductions. Begin by using a withholding calculator to estimate the correct amounts based on your expected earnings. This helps ensure you withhold enough to cover your tax liability without overpaying. The Tax Upnicin Form simplifies this process and provides helpful guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.