Get Quitclaim Deed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Quitclaim Deed online

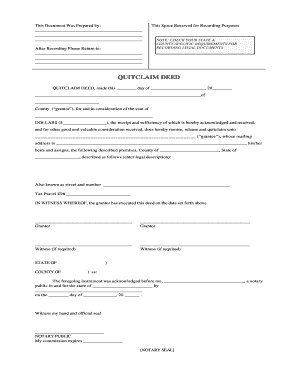

Filling out a Quitclaim Deed online can provide a straightforward way to transfer property rights. This guide will walk you through each component of the form, ensuring you complete it accurately and confidently.

Follow the steps to complete the Quitclaim Deed online.

- Click the 'Get Form' button to access the Quitclaim Deed. This will open the form in a user-friendly editor, allowing you to begin the completion process.

- Enter the date at the top where indicated on the form. Ensure you write the exact day, month, and year when the deed is being made.

- Fill in the name of the grantor, the person transferring the property. This includes their full name and the county where they reside.

- In the next section, provide the consideration amount. This is the monetary value of the transaction. Write the amount in both words and numbers.

- Identify the grantee, which is the person receiving the property. Include their full name and mailing address to ensure legal communication is maintained.

- Describe the property being transferred. This should include the legal description and any other identifying information such as the street address and tax parcel ID.

- The grantor(s) will now sign the document. Ensure all required parties sign where indicated to validate the transfer.

- If necessary, provide witness signatures in the designated areas to meet any applicable state requirements.

- After completing all fields, review the document for accuracy. Make any necessary edits and confirm that all required information is present.

- Finally, save changes, download, print, or share the completed Quitclaim Deed as necessary for your records and for filing.

Complete your Quitclaim Deed online today for a seamless property transfer process.

While a quitclaim deed is fast and simple, it carries certain risks and drawbacks. One significant negative is that it does not guarantee that the grantor has legal title to the property, leaving the grantee vulnerable if issues arise. Furthermore, since it transfers ownership without warranty, the new owner might face unexpected legal claims or liens against the property. Users should be cautious and consider using a quitclaim deed only when dealing with people they trust.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.