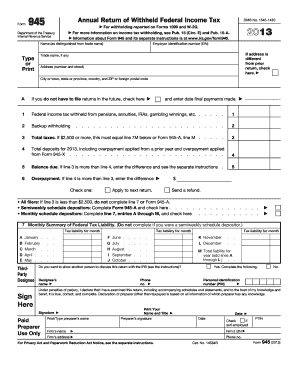

Get F945 Federal Withholding 2012 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F945 Federal Withholding 2012 Form online

Filling out the F945 Federal Withholding form online can seem daunting, but it is a straightforward process when broken down into manageable steps. This guide will provide you with clear, step-by-step instructions to help you successfully complete this form for your federal income tax withholding.

Follow the steps to complete the F945 form online with ease.

- Press the ‘Get Form’ button to access the F945 form and open it in your preferred editor.

- Provide your name as it appears on your legal documents, distinct from any trade name.

- Fill in your Employer Identification Number (EIN) in the corresponding field.

- If your address has changed since your previous return, check the box indicating this change.

- Enter your trade name, if applicable, followed by your address details including street, city, state, and ZIP code.

- Indicate whether you must file returns in the future by checking the appropriate box.

- Report the federal income tax withheld from various sources such as pensions, annuities, IRAs, and gambling winnings in line 1.

- Complete line 2 with the amount of backup withholding, if any.

- Calculate the total taxes in line 3; if this amount is $2,500 or more, ensure it matches line 7M from below.

- Complete line 4 by entering the total deposits made for the year, including any overpayments applied.

- If applicable, calculate your balance due in line 5, or enter the amount of overpayment in line 6.

- For line 7, provide a monthly summary of your federal tax liability if you're a monthly schedule depositor; otherwise, skip this.

- If desired, authorize another person to discuss this return with the IRS by filling in their name and contact information.

- Sign and date the form to declare that the information provided is accurate.

- Finally, save your changes, and utilize options to download, print, or share the completed form.

Complete your F945 Federal Withholding form online today for a seamless tax filing experience.

To look up federal tax withholding, you can refer to the IRS website where resources and guidelines are available. Additionally, your payroll department or accounting software usually has access to withholding information you need. Utilizing tools like the F945 Federal Withholding 2012 Form may also assist in organizing and verifying your withholding details. Gathering this information accurately supports your financial planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.