Loading

Get Virginia Form St 8

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia Form ST 8 online

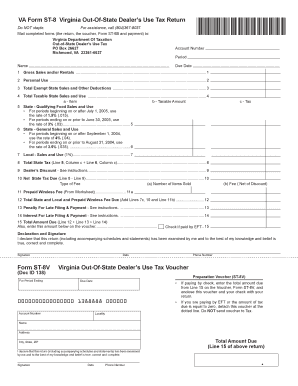

Completing the Virginia Form ST 8 online can streamline the process of reporting and paying state taxes for out-of-state dealers. This guide will provide you with clear and supportive instructions to help you fill out each section and field accurately.

Follow the steps to complete the Virginia Form ST 8 online.

- Press the ‘Get Form’ button to access the Virginia Form ST 8 and open it in your online editor.

- Input your name in the designated field at the top of the form. Ensure the name corresponds to the account holder registered with the Virginia Department of Taxation.

- Enter your account number accurately in the specified section. This number can usually be found on previous tax documents sent from the Department of Taxation.

- Fill in the period for which you are filing the return. This is typically the month and year that corresponds to your taxable sales.

- Complete the Gross Sales and/or Rentals section by entering the total dollar amount of tangible personal property sold or leased along with any taxable services provided, excluding sales tax.

- Record the cost of items used personally in the Personal Use section. This should reflect tangible property taken from your inventory without paying sales tax.

- Include any Total Exempt State Sales and Other Deductions in the appropriate field. Document all exempt sales during the period, supported by proper records.

- Calculate the Total Taxable State Sales and Use by subtracting the exemptions from your gross sales amount.

- Complete the State - Qualifying Food Sales and Use section according to the current tax rates specified based on the period of sales.

- Similarly, fill in the State - General Sales and Use field, ensuring you use the current applicable rate for the taxable amount.

- Declare local sales and use tax in the Local - Sales and Use section, using the rate applicable for your locality.

- Add up the calculations to find the Total State Tax and apply any dealer's discount if applicable, following the guidelines provided in the form.

- Determine the Net State Tax Due by subtracting the dealer’s discount from the Total State Tax.

- Calculate and input the Prepaid Wireless E-911 Fee based on the number of items sold, ensuring you include any applicable discounts.

- Finally, review all entries for accuracy before submitting. Save your changes, then download or print the completed Form ST 8 for your records. You will also want to mail this form, along with the voucher and payment, to the Virginia Department of Taxation.

Begin filling out the Virginia Form ST 8 online today to simplify your tax filing process.

Yes, you can file your Virginia state taxes online with ease. Using services like uslegalforms makes it simple to complete the necessary forms, including Virginia Form ST 8. Filing online not only saves time but also provides confirmation of submission. This is a reliable option for managing your tax obligations efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.