Get Tc689 Online Intermediaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc689 Online Intermediaries online

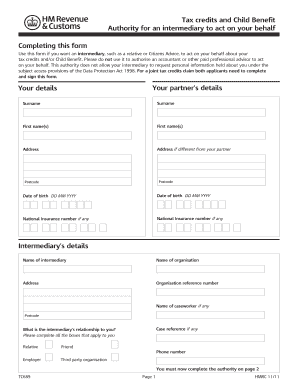

Completing the Tc689 Online Intermediaries form is crucial for allowing a designated intermediary to act on your behalf regarding tax credits and Child Benefit. This guide will provide clear and supportive instructions to ensure you can fill out the form accurately and efficiently.

Follow the steps to successfully complete the Tc689 Online Intermediaries form

- Click the ‘Get Form’ button to access the Tc689 Online Intermediaries form, enabling you to begin the filling process in your preferred editing format.

- Start by entering your details, including your surname, first name(s), and address. If your address differs from your partner’s, ensure to provide their details accordingly.

- Input your date of birth, along with your National Insurance number if applicable. Repeat this step for your partner's information in the designated fields.

- Next, include the intermediary’s details, such as their name and organization, address, organization reference number, and any relevant caseworker information.

- Select the relationship that the intermediary has with you by checking the appropriate box, whether they are a relative, friend, employer, or represent a third-party organization.

- You will need to complete the authority section on page 2 of the form, picking the claim type for which the authority is granted. Ensure that both you and your partner sign the authority, noting that scanned or photocopied signatures are not accepted.

- Finally, review the form for any errors, save your changes, and proceed to download, print, or share the form as needed.

Take the next step in managing your tax credits and Child Benefit—fill out the Tc689 Online Intermediaries form online today.

HMRC usually has four years from the end of the tax year in which you overpaid tax credits to reclaim the overpayment. It is important to keep records and stay informed about your tax credits, as this timeframe is critical for reclaiming any funds. Tc689 Online Intermediaries can help you navigate this process and keep track of your tax credit status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.