Loading

Get Form 8554

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8554 online

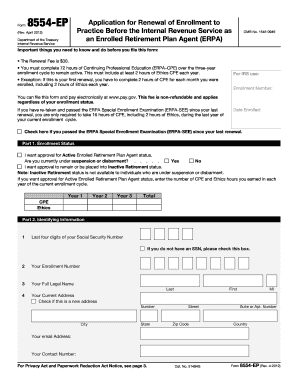

Filling out the Form 8554 online is an essential step for individuals seeking to renew their enrollment as Enrolled Retirement Plan Agents (ERPA). This guide provides clear instructions to help you navigate the form with ease and accuracy.

Follow the steps to successfully complete your Form 8554 online

- Click the ‘Get Form’ button to access the form and open it in the designated online editor.

- Begin with Part 1: Enrollment Status. Indicate whether you are applying for Active or Inactive Retirement status. If you choose Active status, be prepared to enter the Continuing Professional Education (CPE) hours and Ethics hours you earned for each year of your enrollment cycle.

- Proceed to Part 2: Identifying Information. Enter the last four digits of your Social Security Number, or check the box if you do not have one. Fill in your Enrollment Number and your full legal name, including last name, first name, and middle initial.

- Continue entering your current address. If your address has changed, check the box indicating a new address. Provide your email address and contact number.

- Answer the questions regarding your Centralized Authorization File (CAF) number and Employer Identification Number (EIN). Include relevant information for any business names and addresses associated with your EIN.

- Review and respond to additional questions regarding any sanctions, denials of applications, or criminal convictions. If any responses require elaboration, prepare to include additional information on a separate page.

- In Part 3, sign and date the form. Ensure that you declare the information to the best of your knowledge to avoid any processing delays.

- Upon completing the form, review all entries for accuracy. You can then save changes, download, print, or share the completed form as necessary.

Take action now to complete your Form 8554 online and ensure your enrollment remains active.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The penalty for failing to file Form 8854 can be substantial, often resulting in significant tax liabilities and potential loss of certain benefits. If you do not comply with the filing requirements, the IRS may impose fines or additional taxes based on your income. Understanding related forms like Form 8554 is crucial for ensuring that you do not encounter unforeseen penalties during your tax journey.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.