Get Complete If The Organization Answered Yes To Form 990, Part Iv, Line 24a - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Complete If The Organization Answered Yes To Form 990, Part IV, Line 24a - IRS online

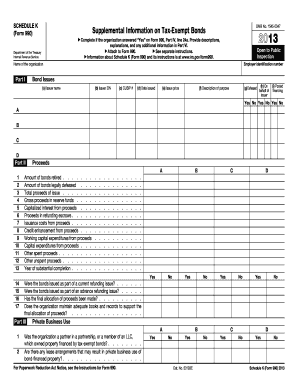

Filling out the Schedule K form is essential for organizations that have answered 'Yes' to Form 990, Part IV, Line 24a. This guide provides clear, step-by-step instructions to assist you in completing this form accurately and efficiently online.

Follow the steps to successfully complete Schedule K.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Begin with Part I, where you need to provide information regarding bond issues. Fill in the issuer name, issuer EIN, CUSIP number, date issued, issue price, description of purpose, and indicate if the bonds are defeased, issued on behalf of the issuer, or part of pooled financing.

- Proceed to Part II to detail the proceeds. Enter the amounts for bonds retired, legally defeased, total proceeds, gross proceeds in reserve funds, capitalized interest, proceeds in refunding escrows, issuance costs, credit enhancement, working capital expenditures, capital expenditures, other spent proceeds, and other unspent proceeds.

- In Part III, assess the private business use of bond-financed properties. Answer the questions regarding partnerships, lease arrangements, management or service contracts, research agreements, and allocate the percentage of financed property used in private business activities.

- Continue to Part IV, focusing on arbitrage issues. Confirm if Form 8038-T has been filed and answer the subsequent questions regarding rebate conditions and variable rate issues. Provide necessary details on hedge agreements if applicable.

- Enter any corrective action protocols in Part V. Indicate if the organization has established written procedures for timely identification and correction of violations related to federal tax requirements.

- Finally, complete Part VI, providing any additional information relevant to the responses in prior parts. This section allows you to elaborate on previous answers or clarify points as needed.

- Review your entries carefully for accuracy. Once complete, users can save changes, download, print, or share the form to finalize their submission.

Begin completing your Schedule K form online today for accurate filing.

Nonprofit organizations typically need to file Form 990, which provides the IRS with a comprehensive overview of their financial activities during the year. If the organization answered 'Yes' to Form 990, Part IV, Line 24a - IRS, they must disclose additional activities, including any unrelated business income. It’s advisable to consult with a platform like USLegalForms for step-by-step guidance on ensuring compliance and accurate filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.