Get E 500g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E 500g online

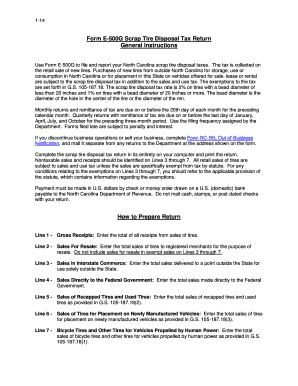

Filing the E 500g form online is an essential task for reporting scrap tire disposal taxes in North Carolina. This guide provides clear and supportive instructions to help you navigate the form effectively, ensuring compliance with state regulations.

Follow the steps to complete the E 500g form accurately.

- Click the ‘Get Form’ button to obtain the E 500g form and open it in your chosen editor.

- Begin by filling out Line 1, where you will enter your total gross receipts from all sales of tires.

- Continue to Line 2 to report any sales of tires made to registered merchants for resale; do not include these sales in Lines 3 through 7.

- On Line 3, report total sales delivered outside North Carolina for use solely outside the state.

- Proceed to Line 4 and enter any sales made directly to the Federal Government.

- For Line 5, enter total sales of recapped tires and used tires as specified in G.S. 105-187.18(2).

- Line 6 requires you to enter the total sales of tires designated for placement on newly manufactured vehicles.

- On Line 7, enter the total sales of bicycle tires and other tires for human-powered vehicles.

- Add the amounts from Lines 3 through 7 and enter the total on Line 8 as your total exempt sales.

- Calculate your total taxable sales by subtracting the amounts from Lines 2 and 8 from the total gross receipts on Line 1. Enter this result on Line 9.

- On Line 10, fill in the total taxable receipts subject to the 2% tax rate for tires under 20 inches, excluding the tax collected.

- Do the same for Line 11, entering taxable receipts subject to the 1% tax rate for tires of 20 inches or more.

- Add the tax amounts from Lines 10 and 11 and record this figure on Line 12 as your total tax.

- If you are filing late, calculate the penalty for filing after the due date on Line 13 and the interest owed on Line 14.

- Finally, add the amounts from Lines 12, 13, and 14, and enter this total on Line 15 as your total amount due. Ensure you save your changes, then download, print, or share your completed form as necessary.

Take the first step in managing your scrap tire tax obligations by completing the E 500g online today.

To dispose of an old car tire, you have several options. First, check if your local waste management service offers tire recycling programs, which safely process these materials. Alternatively, consider taking the tire to a designated recycling center, where experts will handle the disposal properly. Remember, if you need assistance with the legal aspects of disposal, platforms like US Legal Forms can provide you with the necessary documents and guidelines related to E 500g.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.