Loading

Get Calvet Preapproval Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calvet Preapproval Form online

Filling out the Calvet Preapproval Form online can streamline your application process. This guide provides clear, step-by-step instructions to help you navigate the form effectively and efficiently.

Follow the steps to complete the Calvet Preapproval Form online

- Click ‘Get Form’ button to access the Calvet Preapproval Form and open it in your preferred editor.

- Begin by entering your personal information in the designated fields. This may include your full name, date of birth, and contact details. Ensure accuracy, as this information is essential for your application.

- Next, provide your military service information. This section typically requires details about your service branch, rank, and any relevant dates. Review this information carefully.

- Proceed to the housing details section. Here, you will need to specify the type of housing you are seeking, as well as any initial funding information required. Make sure to fill this out completely.

- Review the form sections related to your supporting documentation. This may include uploading necessary proofs, such as military service records or identification. Follow the prompts carefully to attach these documents.

- Once you have completed all sections of the form, take a moment to review your entries for any errors or omissions. A thorough review can help prevent delays in processing.

- Finally, save your changes, and choose an option to download, print, or share your completed form as needed.

Start filling out the Calvet Preapproval Form online today to expedite your application process.

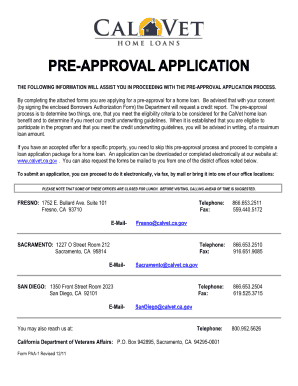

To obtain VA pre-approval, start by filling out the CalVet Preapproval Form accurately. Ensure you provide all relevant documentation, such as evidence of income and military service. Once completed, submit your form to the appropriate VA lender. They will review your application and notify you of your preapproval status, helping you take the next steps toward securing your benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.