Loading

Get Ira Required Minimum Distribution Worksheet

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ira Required Minimum Distribution Worksheet online

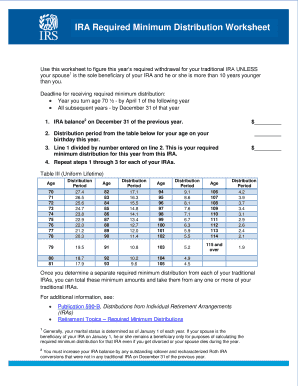

The Ira Required Minimum Distribution Worksheet is a vital tool for determining your annual withdrawal from your traditional IRA. Follow this guide to effectively complete this form online and ensure you meet the necessary distribution requirements.

Follow the steps to fill out the Ira Required Minimum Distribution Worksheet online

- Click ‘Get Form’ button to access the worksheet and open it in your preferred editor.

- Enter your IRA balance on December 31 of the previous year in the first line of the form.

- Identify your age on your birthday this year and find the corresponding distribution period from the provided table. Enter this value on the second line.

- Calculate your required minimum distribution for this year by dividing the value from line 1 by the value from line 2. Enter this result on the third line.

- If you have multiple traditional IRAs, repeat steps 1 through 4 for each account to determine the required minimum distribution from each.

- Once all distributions are calculated, you can combine these amounts and choose to take them from any one or several of your traditional IRAs.

- After completing all entries, ensure to save your changes, and download or print the completed worksheet for your records.

Start filling out your Ira Required Minimum Distribution Worksheet online to ensure timely and accurate withdrawals.

Related links form

Filling out an RMD form can seem complicated, but it doesn’t have to be. Start by gathering your financial information, including your account balance and life expectancy factor. The IRA Required Minimum Distribution Worksheet can assist you in accurately completing the form, making the overall process straightforward and ensuring you meet your RMD requirements without any issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.