Get Pre-payment Of Real Property Taxes And/or Nid Assessment Form. Pre-payment Of Real Property Taxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pre-Payment Of Real Property Taxes And/or NID Assessment Form online

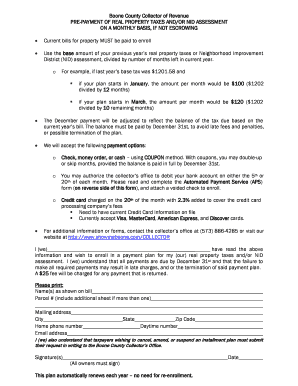

This guide provides a step-by-step approach to filling out the Pre-Payment Of Real Property Taxes And/or NID Assessment Form. By following these instructions, users can effectively complete the form to manage their property tax payments.

Follow the steps to complete your form easily:

- Press the ‘Get Form’ button to obtain the form and access it in your preferred editor.

- Begin by entering your name(s) as shown on the property tax bill in the designated field.

- Input your parcel number, making sure to include additional sheets if you have more than one parcel.

- Fill out your mailing address, including city, state, and zip code, completely and accurately.

- Provide your home phone number and a daytime phone number where you can be reached.

- Enter your email address for further communication regarding your tax payment plan.

- Read the statement regarding your understanding of the plan and payment responsibilities, and sign where indicated.

- If opting for automated payments, complete the Authorization Agreement for Automated Payments section, including bank information.

- Indicate whether you prefer your payment to be debited on the 5th or 20th of each month.

- Attach a voided check to the authorization form to ensure proper processing.

- Review all entries for accuracy, then save your changes, and download or print the completed form.

Complete your Pre-Payment Of Real Property Taxes And/or NID Assessment Form online today.

In Washington, there is no specific age at which you automatically stop paying property taxes. However, certain exemptions may apply for homeowners over the age of 61 or those who are retired from the workforce. It is advisable to explore the Pre-Payment Of Real Property Taxes And/or NID Assessment Form as a tool for easing your tax burden. You can consult with uslegalforms to help you navigate these exemptions effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.