Loading

Get Dtf 801 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dtf 801 Form online

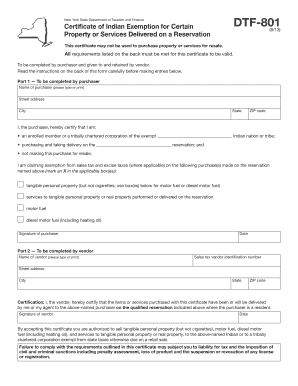

The Dtf 801 Form is essential for individuals and tribally chartered corporations seeking an exemption from sales tax and excise taxes on eligible purchases made on a qualified reservation. This guide provides clear and detailed instructions for users to complete the form online effectively.

Follow the steps to complete the Dtf 801 Form online.

- Click ‘Get Form’ button to access the Dtf 801 Form and open it for editing.

- In Part 1, enter your name as the purchaser. Ensure to type or print clearly to avoid any issues.

- Certify your status as either an enrolled member or a tribally chartered corporation. Check the appropriate box to confirm that you are making the purchase for personal use and not for resale.

- Mark an X in the applicable box(es) to specify the nature of your purchase, whether it is tangible personal property, services to property, motor fuel, or diesel motor fuel.

- Sign and date the form to validate your certification as the purchaser.

- In Part 2, the vendor must fill in their name, sales tax vendor identification number, and address details. The vendor should also certify the delivery of the items or services to you on the qualified reservation.

- Once completed, save the changes to the form. You may then download, print, or share it as needed.

Complete your Dtf 801 Form online today to ensure your eligibility for exemptions!

In Oklahoma, organizations like non-profits, government entities, and certain educational institutions can qualify for sales tax exemption. Additionally, purchases like machinery for manufacturing and some agricultural products may also be exempt. Always check the specific criteria and obtain the necessary forms to regulate your exemption status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.